Breaking Down Adyen

Adyen, the first company we're analyzing on this site, is one you've likely encountered numerous times without realizing it.

In this article, we'll delve into Adyen's operations, its clientele, the workings of the payments industry, and conduct an in-depth analysis of Adyen's financials.

Subscribers will have complete access to this write-up, including the ability to download a financial model where you can input your own assumptions about the company.

How Payments Work

Billions of times a day, credit cards are swiped or numbers are entered to complete a transaction.

Things like your morning coffee, or your Spotify subscription renewing for another month trigger a sequence of events that very few of us ever really dive into. Well, until today.

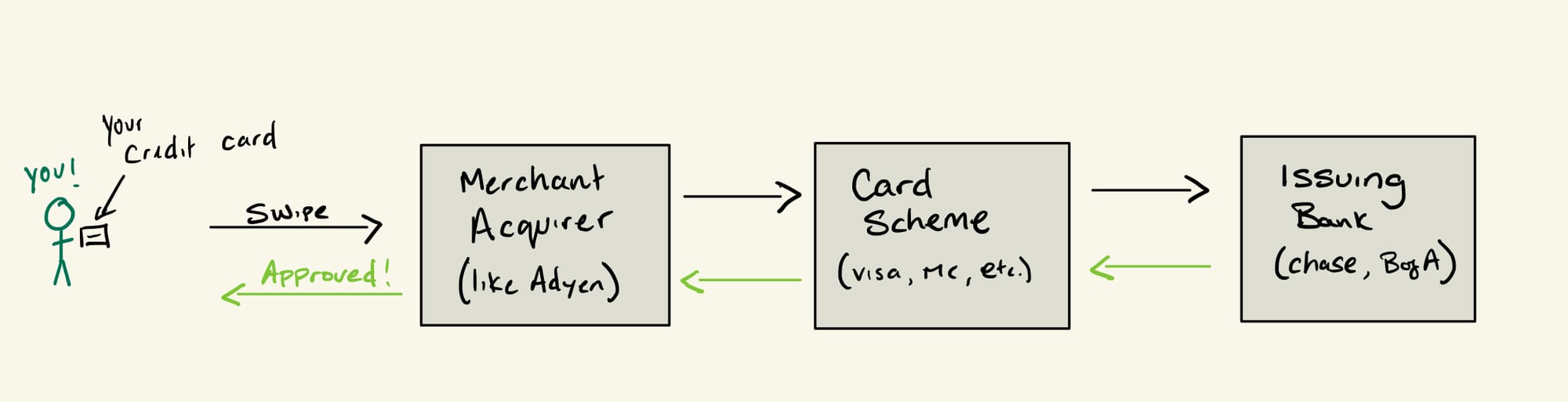

Let's assume you're at Starbucks and you're about to pay the $7 for that morning caffeine boost. You pull out your card, you tap it on the payment terminal and a second or two later "Approved" pops up on the screen - here's what's happening.

First, the payment terminal retrieves your card information and sends it to a payment gateway, which then structures the transaction.

This information then goes through a number of steps that include risk management, vetting, and all kinds of other processes that largely depend upon the merchant's setup.

Following risk management, the transaction undergoes 'processing & acquiring' by the acquiring bank, which represents the merchant (Starbucks, in this example). The acquirer communicates with the card schemes (like Visa and Mastercard) to provide them the necessary details.

I'm breaking a sweat here.

Finally, card networks like Visa and Mastercard communicate with the issuing bank (your bank) to confirm you have sufficient funds for the purchase. If your issuing bank gives the thumbs up you see that "approved" message. If they don't, or if there's an anomaly on the way there, you're going to get declined.

So here's your first fun fact: roughly 15% of online and 5% of real-world transactions are declined. Adyen aims to solve that.

We'll get to Adyen more in the next section, we're not even done with the payment flow yet. Next up, after approval, things can go a lot slower. What happens though is that the acquiring bank receives funds from the issuing bank - usually the same day of the transaction. This money is then paid to the merchant, while the acquiring bank collects its fees from the transaction proceeds.

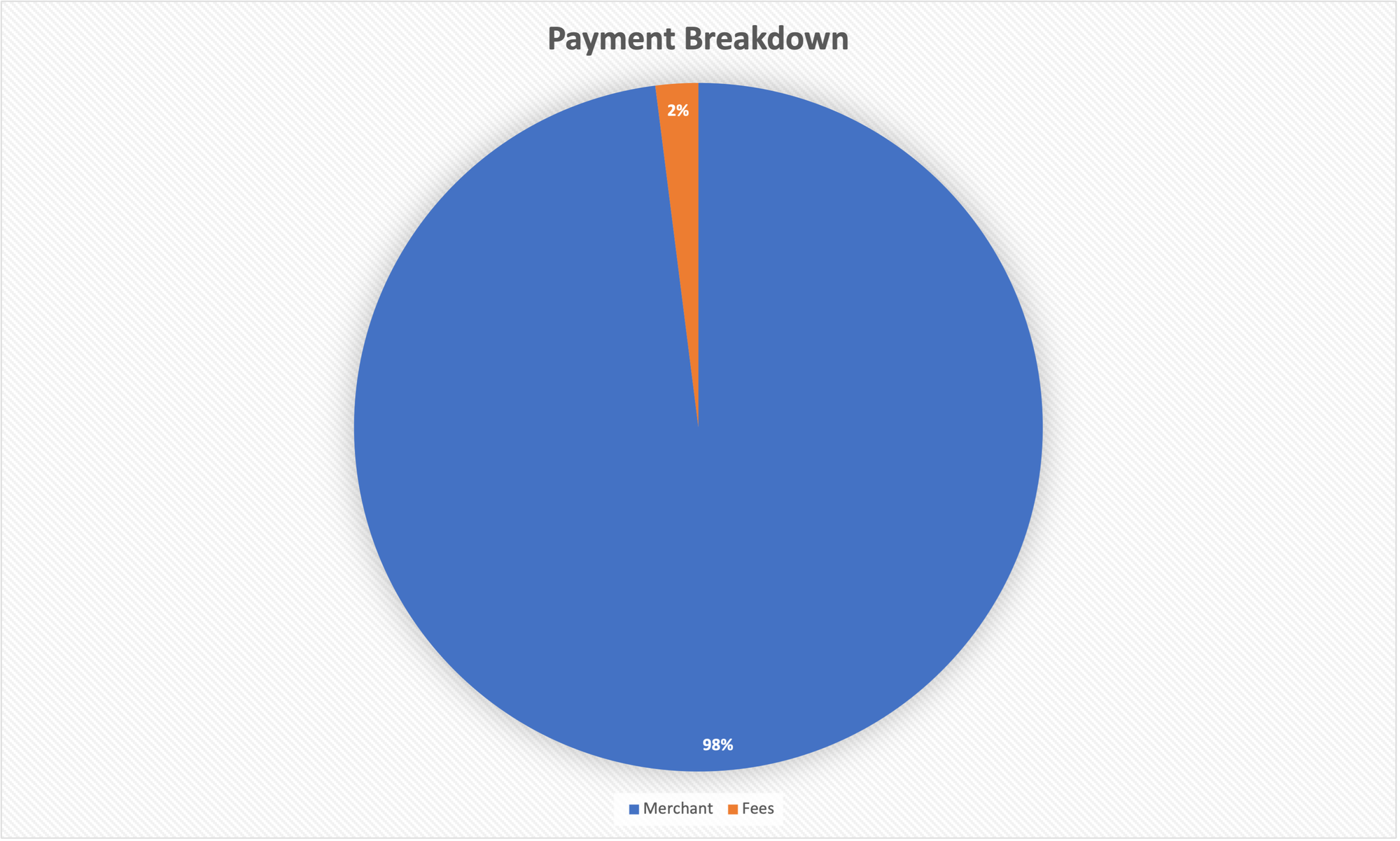

Starbucks, or any merchant, pays for these services as a percentage of the transaction. It's typically 2%, or thereabouts, so that $7 coffee would "net" Starbucks $6.86 after a $0.14 transaction fee.

Roughly 11-cents of that would go to the issuing bank (1.6%) while the card processors (Visa / Mastercard) would get 1.4-cents (0.2%) and the acquiring bank would collect 1.4-cents (0.2%). These might seem like incredibly small numbers, but when talking about billions of transactions a day - it adds up.

So, to wrap this up, there are many parties involved in processing transactions. You have the customer, the merchant, a gateway processor, an issuing bank, card networks, merchant acquirers, and others depending on how custom the setup is.

Decisions are made behind the scenes as to whether or not your payment will go through in a matter of seconds, and roughly 5% of all transactions are declined (in the real-world).

Adyen is looking to simplify this process and bring that 5% down. Let's dig into this a little bit more.

What Does Adyen Do?

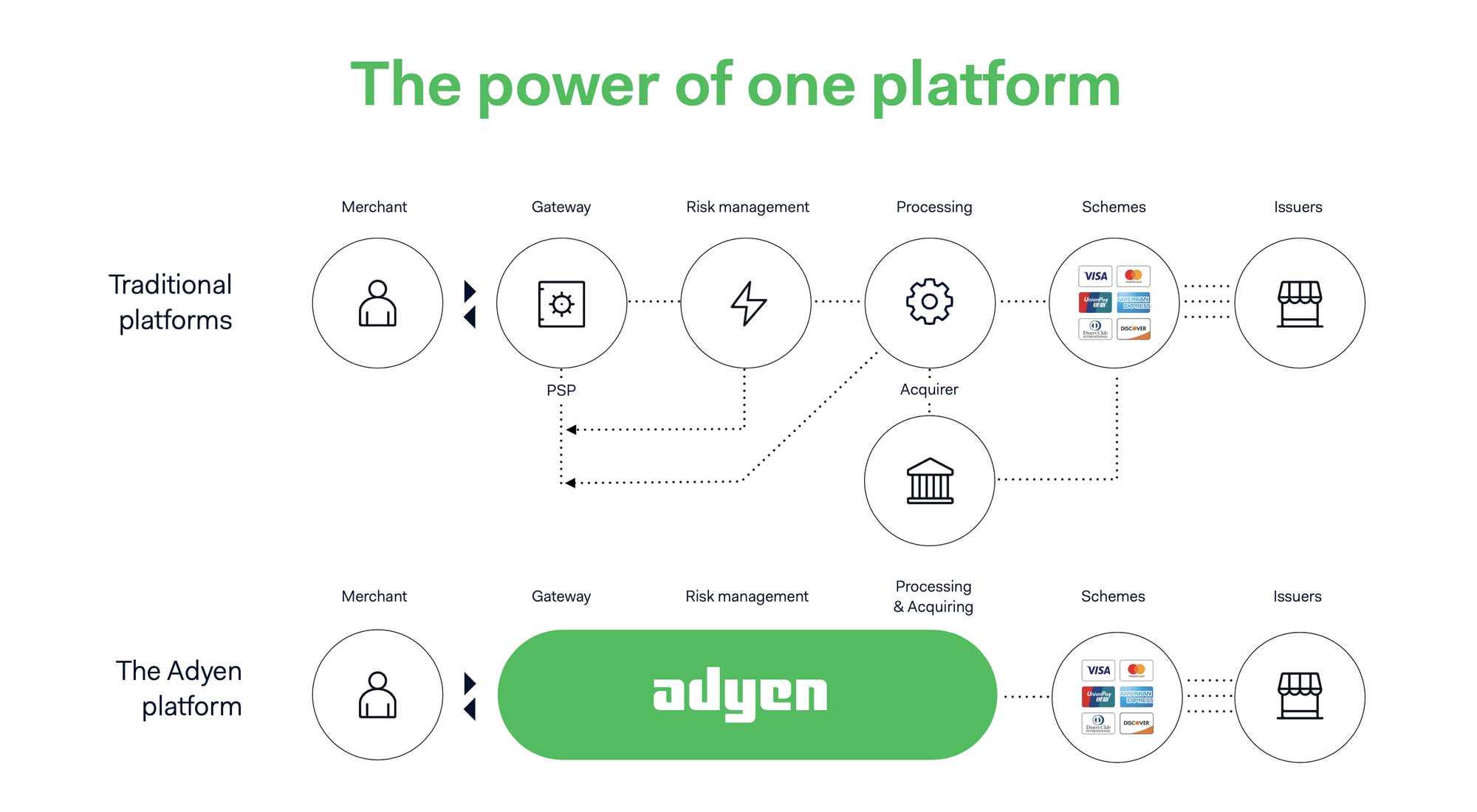

Adyen, founded in 2006, is a Dutch payment company that fulfills the role of "acquiring bank" in the transaction chain described above.

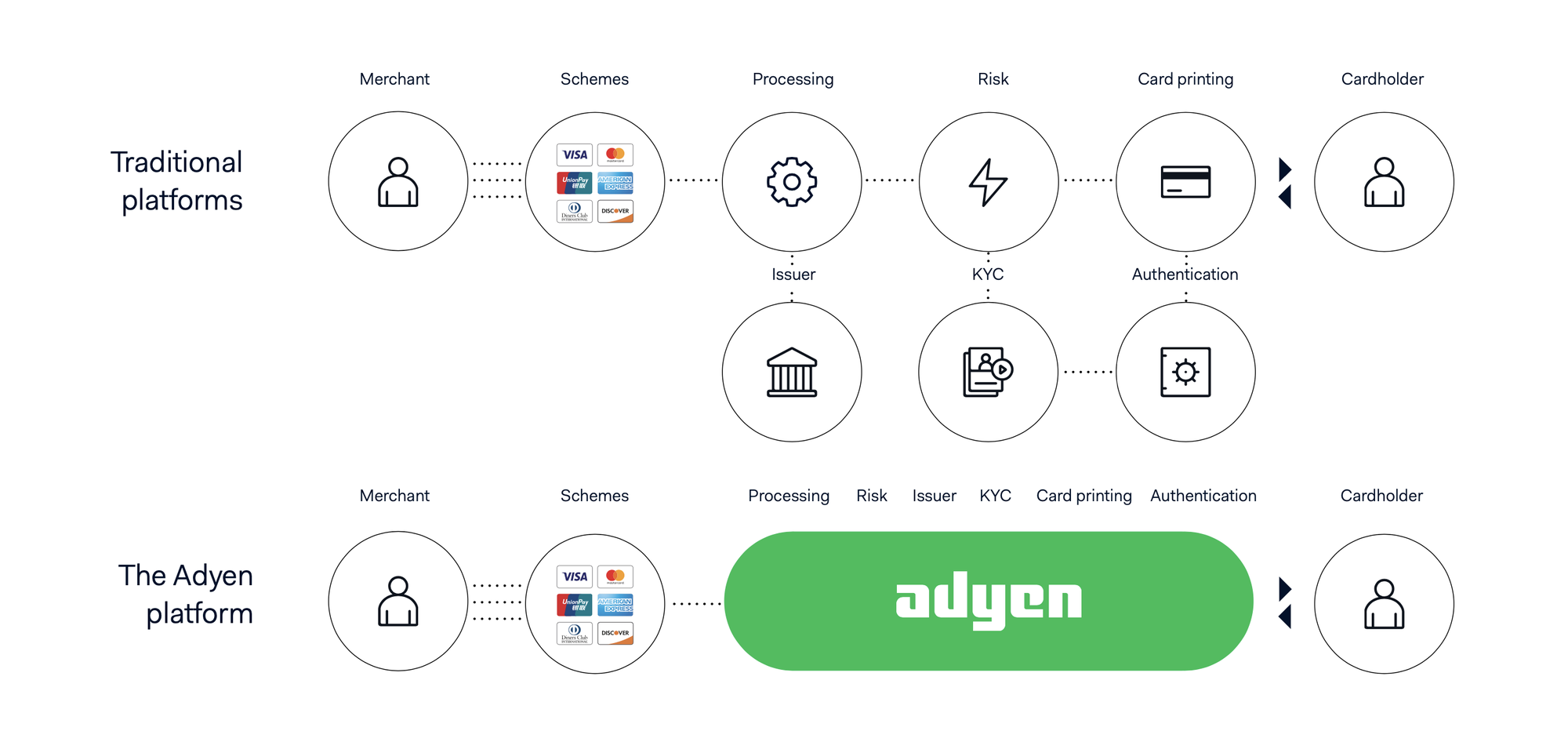

The best way to visualize this is with the above. Adyen fulfills the role of gateway, risk management, processing & acquiring for their customers. This removes many pieces of the puzzle from consideration and leaves merchants with a simple path through the payment lifecycle.

By taking on many pieces of the puzzle, Adyen is able to help merchants boost their overall approval rates, simplify communication, and help merchants break into new markets with ease.

Adyen has also recently developed a platform for issuing. Being an issuing bank means that Adyen can allow customers to offer their own financial services. These services, encompassing credit cards, KYC, authentication, and more, enable Adyen to partake in the 1.6% fee segment discussed earlier.

Alongside both of these products, Adyen also offers the necessary hardware and software to make payments a breeze. If you've eaten at a Subway you've likely made a payment on a piece of Adyen hardware, and there's an even better chance you've used the company's offerings online.

Therein lies one of Adyen's problems though - it's not a household name. Visa, Mastercard, American Express, those are brands that consumers interact with and can choose to suit their needs. Likewise, a consumer can choose the issuing bank they get their card through. No consumer is out there choosing to only do business with merchants using Adyen as their acquiring bank.

Adyen then offers a service that can be easily commoditized. If a cheaper provider comes along offering the same services for 0.1%, a merchant would gladly switch (it's somewhat difficult, but again 0.1% over thousands of transactions through the years could really add up).

Companies typically put out a request for proposals on their payment service providers every 3-5 years. Adyen, fortunately for them, has been winning a large number of these RFPs of late. Companies like Spotify, Uber, Ebay, McDonald's and Subway have trusted the most critical part of their business, receiving money, to Adyen. Why?

Adyen has a number of differentiating features that are aiding business growth right now. We'll cover a couple of them in the sections ahead, but I wanted to start with the one that is near and dear to my software engineering background heart: simplicity.

Adyen's biggest differentiator, and biggest "pro" for their business going forward is the company's simplicity when it comes to product development. They achieve and maintain this simplicity by sticking to "The Adyen Formula."

We don't need to hit upon every one of these points, but I would like to touch on a couple that I think help Adyen stand out. First, "We build to benefit all customers."

By building to the benefit of all customers, Adyen is avoiding costly custom development. Not just costly from a creating it today perspective, but costly from a years of maintaining it perspective. Does this mean that they miss out on landing some customers who need a more custom touch? Probably. Is that bad long-term? Not at all.

With an almost certainty I can say that Adyen will not capture 100% of the market, likely never north of 50%, but that's not a bad thing in a market the size of payments (tens of trillions per year).

In conjunction with benefiting all customers, Adyen also aims to "make good decisions and consider the long-term benefits for our customers." So, should a Nike come along and request a custom feature, Adyen will consider it, as long as it is a good decision for all.

Finally, "We create our own path to grow toward our full potential." This one is key. Adyen build software unlike many large businesses in that they do not acquire, and do not use third-party integrations.

As someone who's built a career in software development I can tell you that this is exceedingly rare. Typically, if you need a feature and it exists to buy via some provided API, you'd do so and integrate it.

Occasionally, a competitor does what you need and you buy that firm to integrate its tech. Both of these paths result in "messy" code, despite how hard we might try, that adds to maintenance going forward. Adyen, by owning the entire lifecycle from start to end means they have complete control over how things work, can deliver quicker, and will have fewer issues over the long-term supporting that software.

That, to me, is the thing that will help Adyen in its future growth the most. While competitors might struggle and stumble around integrations and custom development, Adyen will be free to adapt to the market in their own time.

I saved this point to last in the section as it does offer an excellent segue into Adyen's competitors. Let's take a look at those next.

Who Does Adyen Compete With?

Adyen does not have a shortage of competitors, especially as the company branches across the payment stack. Focusing on legacy payment service providers first though we have some big names.

In the United States, three major legacy acquirers are Chase Paymentech, Worldpay (FIS), and First Data (Fiserv), offering merchants traditional payment processing services. All three of these have something in common: they're riddled with "tech debt."

Tech debt, as described earlier, refers to years, or in the case of the software above, decades of bad choices that have compounded to make building new features cumbersome and difficult.

In terms of size, these merchant acquiring legacy providers touch a lot of volume. Chase Paymentech is able to authorize transactions in more than 130 currencies and processes well over half a trillion dollars in payments annually.

It's also worth focusing on Chase a little bit more than the other two as it has a distinct benefit. Chase is the issuer of around 17% of credit cards in the United States (and countless more debit cards). This gives the company a much easier path to approval for 17% of cards out there. which in turn leads to lower rejection rates at the point of sale for Chase Paymentech users. A lower rejection rate can be worth its weight in gold for some merchants.

Beyond legacy providers, Adyen faces competition from modern disruptors like Stripe and Checkout. The key difference between the two, in my eyes, is that Adyen focuses on established enterprises while Stripe focuses on startups.

Stripe will sell to enterprises, sure, but it's very much a land & expand business. They make it easy to accept payments from day one with absolutely no resources and hope that you'll one day grow to be a behemoth accepting millions of dollars.

Adyen does not touch that small market. Adyen's sales efforts are focused two-fold. First, on the enterprise. Ideally a business accepting billions of dollars worth of payments, but those in the millions work too. The second focus is on platforms, not the small business itself.

A quick segue on that. A "platform" in this regard is a piece of software for the small business. Think a hair salon management tool for example. It allows for scheduling of haircuts, and scheduling of the workforce, it also helps process payments. Adyen would look to be that payment processor. A single relationship with the platform, but many customers down the line.

Who Are Adyen's Customers?

Let's explore the companies that use Adyen, as well as potential users.

Adyen, as we mentioned in the last section, is primarily focused on the enterprise space. Their sales teams are out trying to convert massive brands, restaurants, stores, and services over to Adyen, and they're doing a good job.

At their most recent Investor Day, Adyen highlighted Burton as a newly acquired customer. Burton chose Adyen for its extensive reach and the convenience of having all payment services integrated into one tool.

Other customers include the likes of Uber, eBay, Spotify, and McDonald's. These are all companies processing billions of dollars in volume annually, and great proof that Adyen's tooling works at a massive scale.

The company doesn't differentiate or go after one particular domain. Digital businesses, in-person retail, and omnichannel (meaning digital & in-person) are all target markets for Adyen, as are the aforementioned platforms and marketplaces.

Management Philosophy

While we have touched upon management philosophy at various points throughout this breakdown, I think it's worthwhile to give it its own space.

First, a brief recap of the points we've covered. 'The Adyen Way' comprises a set of guiding principles the company adheres to in all its decision-making processes. These basic rules, if stuck to, will help Adyen maintain an advantage over legacy players in the space, and they'll help the company build a solid & stable platform that can carry them into the future.

Secondly, our discussion included Adyen's focus on enterprises as opposed to small to mid-sized firms. Adyen chooses to focus on the enterprise. Smaller businesses end up utilizing Adyen by way of a platform or marketplace (think Etsy, or Lightspeed).

An area we haven't spoke about yet, and which will play a significant role in the success of this company, is the employees. Adyen operates with a leaner staff compared to its competitors and generally offers lower overall compensation to its employees. We're going to spend the remainder of this section digging into those two points.

On the "lean" front, Adyen estimated during its most recent Investor Day that it would end the year with 4200 employees. Compare that to closest competitor Stripe which has between 7,000 and 8,000 employees or a company like Fiserv that has north of 40,000.

If you click through on either of those links you'll notice they're both to articles that mention layoffs, something that Adyen has not had to deal with. Adyen, despite everyone else going on a hiring spree during COVID chose to keep things simple. It is a company that has grown at its own pace, and will continue to grow at its own pace.

In 2024, Adyen expects to add a couple hundred employees around the world.

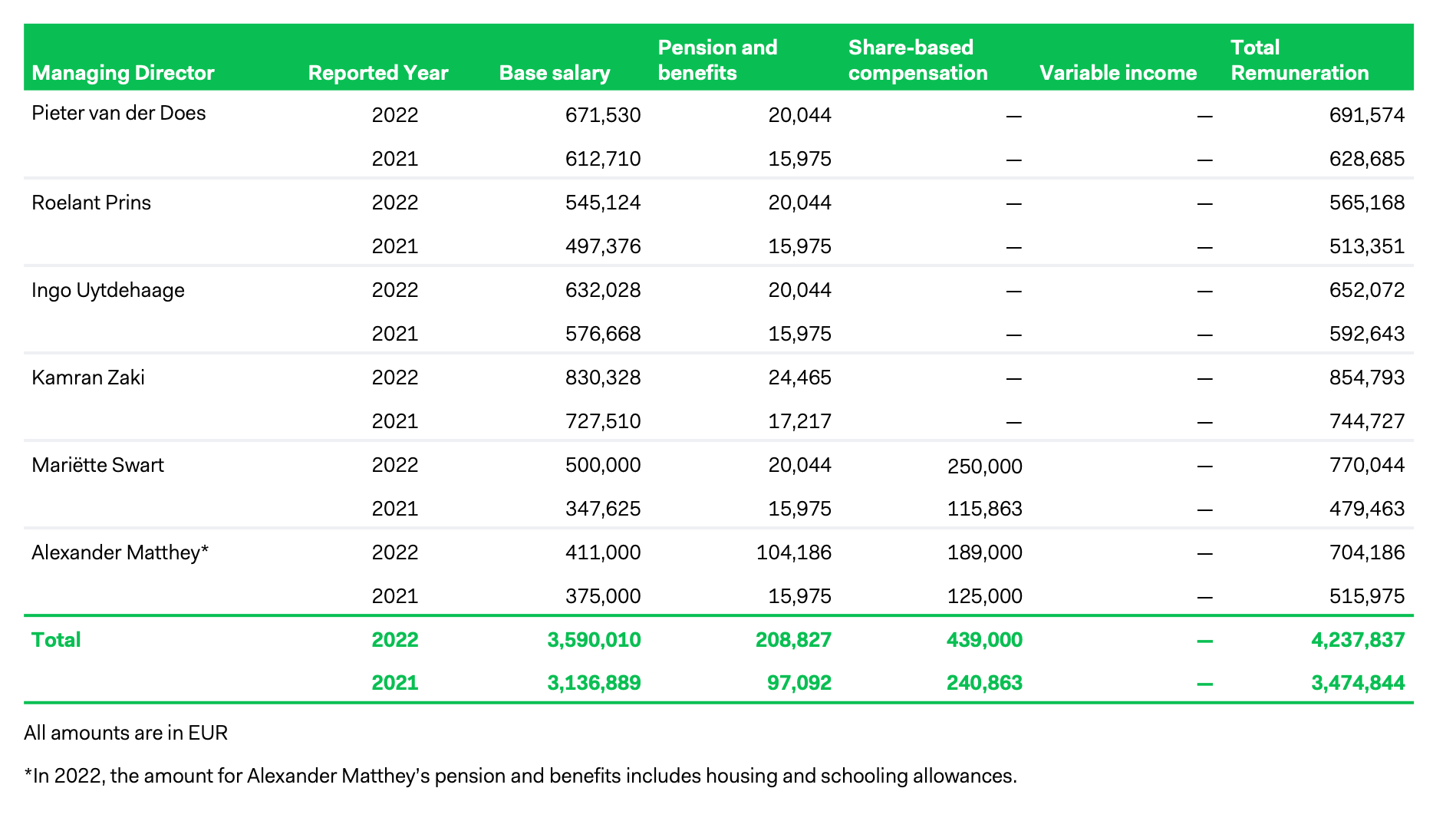

Those employees all receive a salary. Adyen tends to pay a little below market when considering its counterpart, Stripe. The company has also steered away from providing massive amounts of stock.

The table above shows the salaries of managing directors at Adyen. While the company does not state a goal, the CEO is paid at a ratio of 7:1 the average Adyen employee. Quick math then tells us that the average Adyen employee makes around $98,000 in total compensation.

We will dig deeper into compensation as a possible "con" of Adyen in the pros/cons section. In short, the company will have to step up to market levels over time, and if it fails to do so it might not be able to attract a high-level of talent that will be needed to compete.

How Does Adyen Make Money? Where Will Future Growth Come From?

Note: Adyen reports in Euros, we're using Euros below.

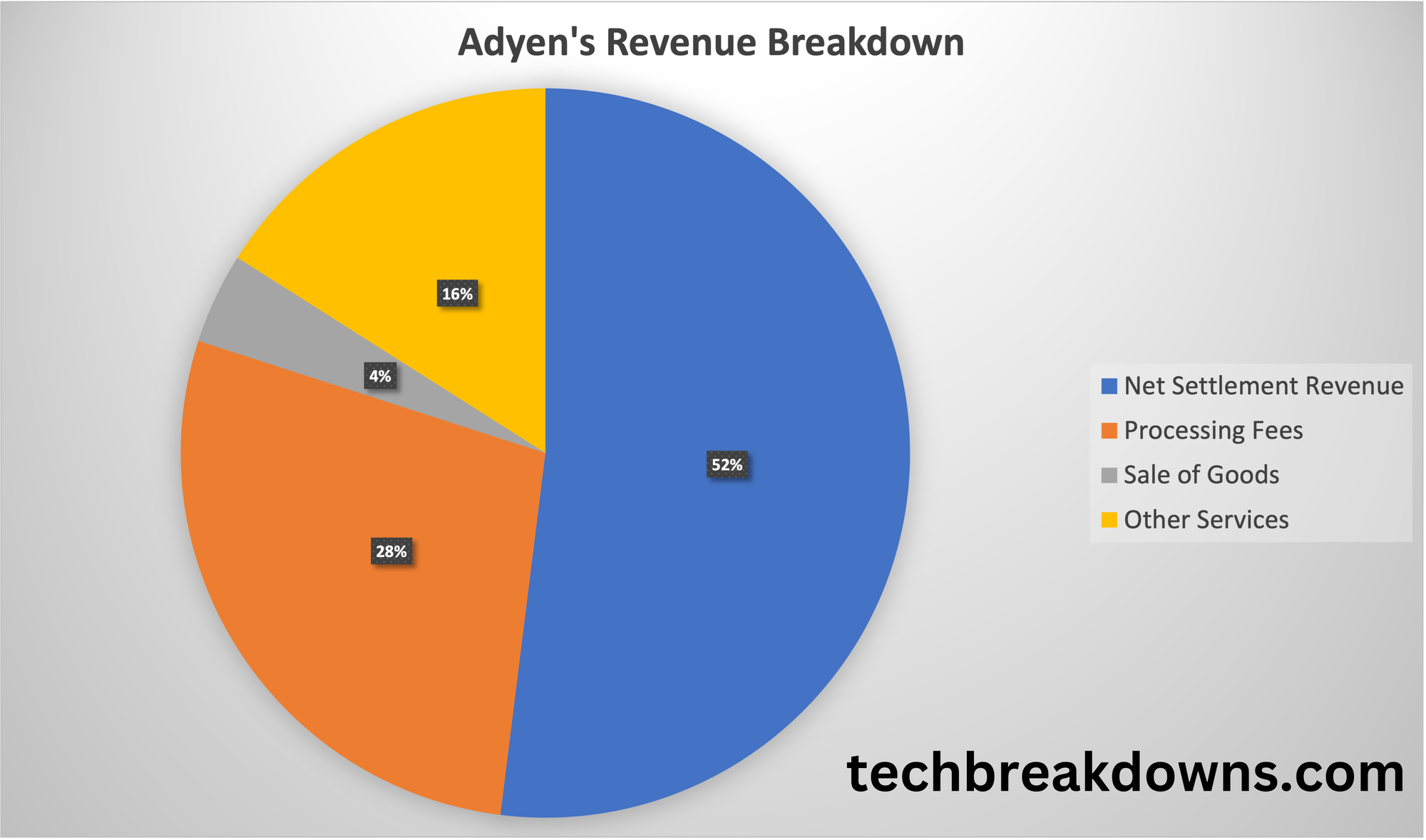

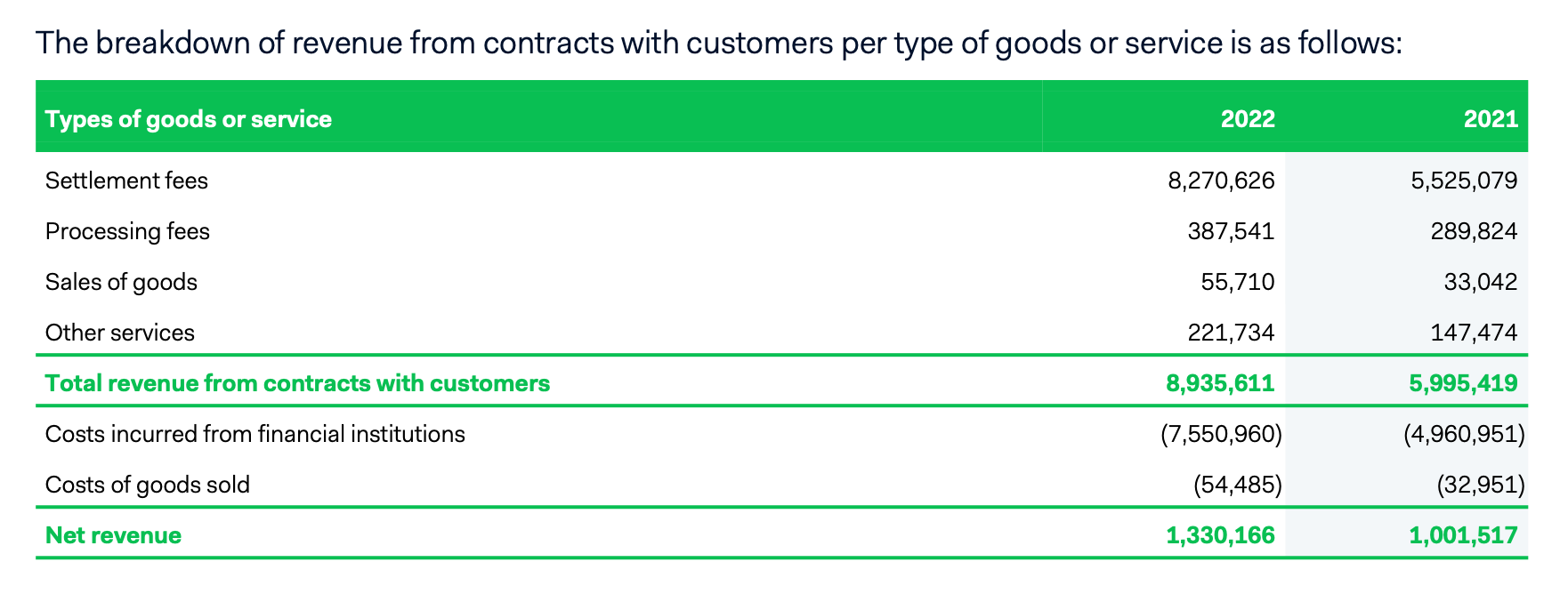

Money! Adyen has four segments it reports on, making up the large majority of the company's revenue.

The primary source of revenue for Adyen, which is expected to continue as such, is settlement fees. Settlement fees are driven, almost entirely, by total payment volume (process more money, collect more revenue).

Settlement fees are fees that are paid by merchants for Adyen's acquiring services. Adyen prices these services using a pricing model that charges merchants the costs Adyen incurs plus a mark-up - that mark-up is contractually agreed on with merchants.

Processing fees, a much smaller bucket, are made up of fixed fees paid by merchants for the use of Adyen's platform. Again, these are contractually negotiated rates.

Sales of goods, contributing a smaller portion of revenue, encompass the sale of POS terminals and related accessories.

Finally, 'other services' encapsulate foreign exchange service fees, third-party commissions, and issuing services.

In 2022, settlement fees generated €8.27B in annual revenue. From this, the company had to pay €7.55B to financial institutions, resulting in €720M in net revenue from Adyen's largest segment.

Processing fees were €387M, sales of goods (POS terminals) brought in €55.7M, and other services added €221M to the top line.

As it stands, there's no reason to suspect that these buckets of revenue will shift dramatically in the near-term. Adyen is looking to continue expanding in the four areas discussed, which will result in settlement & processing fees growing as a share of net revenue. Sale of goods will grow, but not to the same extent as the world continues to shift away from POS terminals, and to tooling like iPads, iPhones, and other generic peripherals (not to mention online shopping).

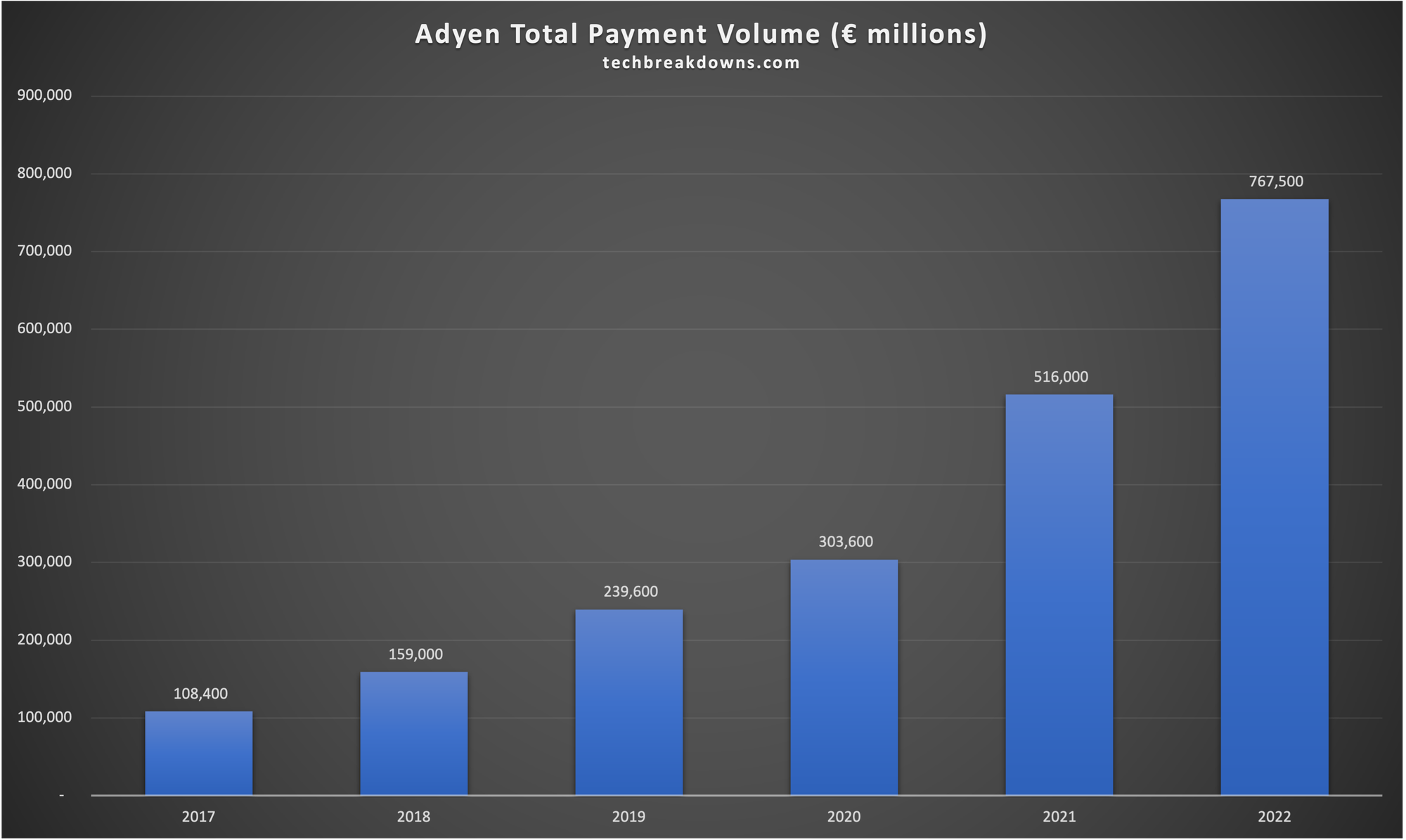

As noted a couple of paragraphs prior, the key driver of revenue growth is total payment volume. It's a simple formula - process more equals make more. In 2022, Adyen processed €767B. In H1 2023 (Adyen only reports twice per year), Adyen processed €426B in payments, so it's well on its way to crossing €1T in 2024.

Pros and Cons to Investing

We come to the investing portion of the breakdown. Note that I do not make buy or sell recommendations, and recommend you do your own research before making such a decision. My thoughts here are just that, thoughts. I could be wrong, I could be right - but I'm making a lot of "best case scenario" type guesses.

Well, there's the disclaimer, here's what I like about Adyen. The significant growth in Adyen's total processed volume is a positive indicator. This is going to be a key driver to long-term success and seeing the company land names like McDonald's and eBay goes a long way to making this an investable name.

I also like that we're seeing Adyen expand into the issuing side of the business. There's a lot of money to be made here, and a massive business could be build around simplifying the whole payments stack.

Adyen is a roughly $35B company today that's trading significantly off its 52-week low that came after reporting H1 2023 earnings. In hindsight, that was an incredible buying opportunity for the long-term as buyers could have already locked in a 100% return.

Lastly, among the pros, 'The Adyen Way' stands out. I like that this company is founder-led, it has a vision, and they've stuck to that vision since founding the firm. Thus, losing Pieter van der Does (founder & CEO), could be considered a big blow to Adyen's future, especially if those replacing him do not agree with what has been established. Pieter is just 54 years-old, so there's no immediate concern of departure for right now.

Turning to the cons, there are a few. First, this is a very competitive business that can and likely will be commoditized over time. Adyen's "cost+" style of pricing could be disrupted by an upstart that chooses to make that "+" much smaller.

The counter to this point is that merchants also need to trust their payment service providing partner. Adyen has built a great deal of trust and can charge a premium for that trust. Newcomers would have to prove they can accept cards at the same rate as Adyen for a cheaper price, a big hill to climb.

The space also has a lot of room in it. There's not going to be a winner takes all scenario in payment processing, and Adyen can for sure be a huge company even if it doesn't capture the most share.

Another con worth considering, and this appears to be getting "worse" the longer it takes me to write this article, is valuation.

In September, Adyen's stock traded between $6 and $7 on U.S. exchanges. Today, it's in the $12-13 range. Sure, it's still got a 50% gain in in before it touches 52-week highs, but that kind of level would require significant multiples.

At a presumed €1.7B in net revenue for 2023 (+27.8% year over year), Adyen today trades at 22x sales. 22x sales is fine for a company that can continue to put in 20% growth year-over-year, but if that continues to slip, Adyen's multiple will certainly compress.

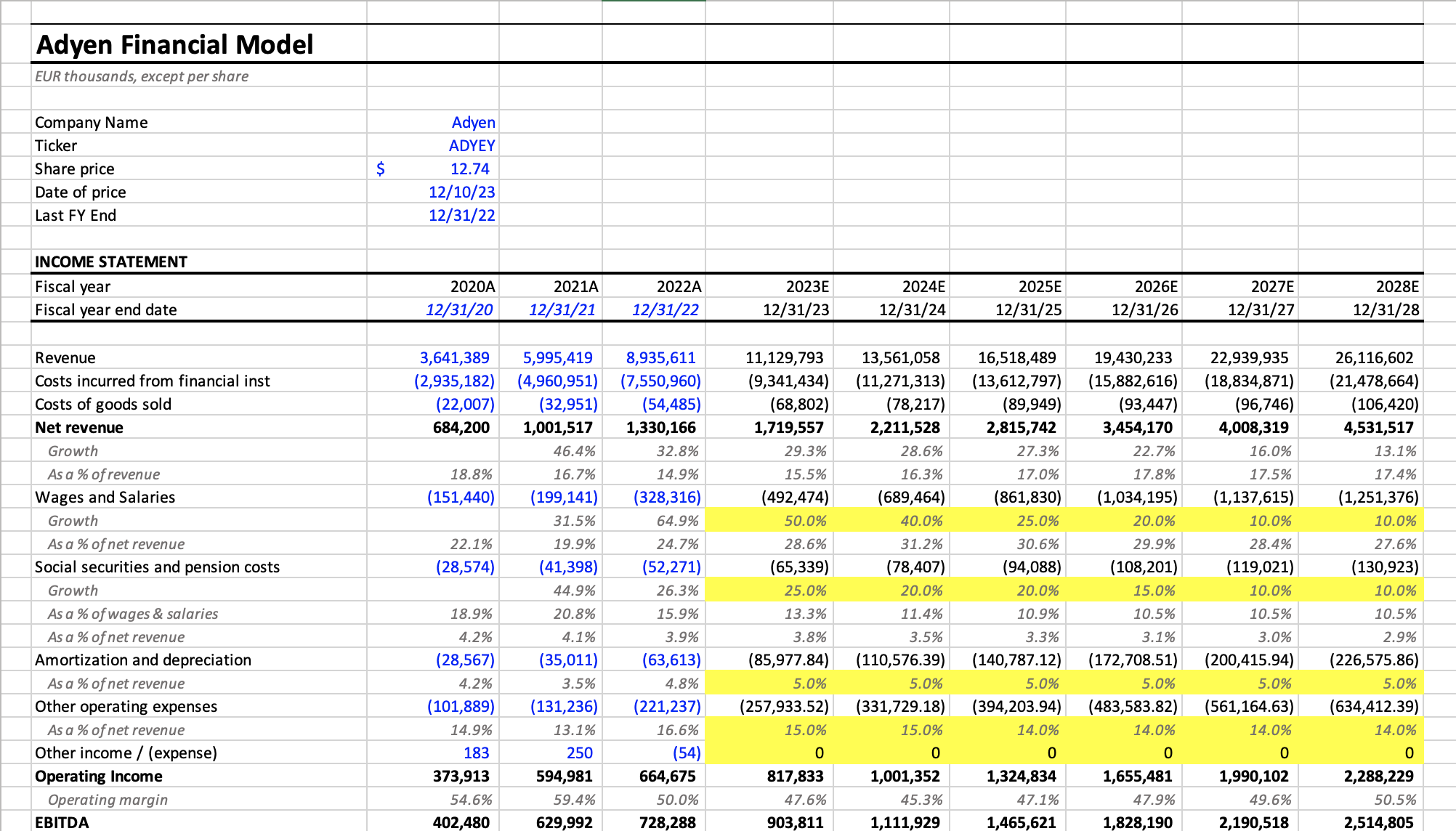

Model Discussion

Subscribers have access to the models I make. The purpose of these models is to allow users to experiment with different scenarios and understand what companies must achieve to reach specific valuations.

Wondering what the model looks like before subscribing? I published a video on YouTube digging into it:

(note: the model here is what was created at the time of publication. Go to the models page for potentially updated models)

The model then, as uploaded, is not expected to be a source of truth, but rather a tool potential investors could use to guide their vision and story for the company. Let's discuss it.

For Adyen, the whole story really relies upon total payment volume. The quicker, and earlier, Adyen grows total payment volume, the better the downstream effects become.

At the close of 2022, Adyen processed €767.5B. This represented a growth of 48.7% over 2021. Those that have followed Adyen know that the company did not maintain 48% growth in TPV this year, rather it came in at 23% for H1 2023. This growth, while commendable, sent shockwaves through the Adyen shareholder community, resulting in a significant drop in the stock price.

The model I have put together assumes that H2 will perform a little better and result in 25% year-over-year growth with Adyen processing €959B in TPV, inching ever closer to that €1T mark.

With all other elements of the model staying consistent, 25% growth in FY23 gives us a per share value of $14.10 at an exchange rate of 1.08. 24%, a 1% lower growth rate results in a $13.98 value while 26% gets us to $14.21. No other variable in the model has such a pronounced effect.

Above is a screenshot of my model, as uploaded. This is what I believe to be a fair assumption of the Adyen story at an 8% discount rate. We'll not dig into discount rates and WACC (weighted average cost of capital) values here, but I tend to skew between 8-12% personally, and pull WACC from Finbox.

As you can see, I get an equity value of $14.10 for Adyen, a 10.6% margin of safety over the price when writing. This is not a significant enough margin of safety in my opinion as I'd tend to look for 15-25%.

I'd encourage readers to play around with and update the model over time. It will be in the resources section of TechBreakdowns and updated over time with updated information.

Closing Thoughts

Adyen is exceptionally well-managed and is poised to become a household name in the payments sector. The payment space is large enough for many players, and Adyen will be one of them.

While legacy providers will continue to play an important role, companies like Adyen and Stripe are expected to gain more market share over time, thanks to their simpler technology and the ease of updates.

As a software engineer myself, I am jealous of the company's ability to keep things in-house and to avoid using third-party integrations. This is, and will continue to be, a massive differentiator for Adyen.

Still, at an assumed fair value of $14.10, Adyen is priced a little too high today. The best time to buy would have been when the name was riddled with fear.

Member discussion