Defying the Innovator's Dilemma: Apple's Path to Sustained Growth

Exploring how Apple defies the Innovator's Dilemma with strategic innovation and its visionary approach to shaping the future of technology.

The Innovator's Dilemma offers invaluable insights into business challenges. I highly recommend reading it. However, this discussion focuses on Apple, a company that, despite nearly $400B in revenue, seemingly defies the book's lessons.

A key lesson from the book is the innovation challenge large companies face. Their extensive revenue streams often make experimentation and new ventures daunting.

If your firm has $5B in revenue and a $1B opportunity emerges, you’re likely interested. That’s a chance to add 20% to your top line. If you’re Apple with $385B in revenue, you’re probably going to wait for a larger opportunity. After all, that $1B business will only help you grow 0.2%.

Consider the VR headset market, valued at $1 billion in 2022 and $700M in 2023. Apple's entry into this market might boost its revenue by a mere 0.2%. So, why bother?

Of course, the point is to skate towards where the puck is heading. Apple as a company is choosing to innovate and create markets, to create new platforms, to capture users in new ways. It’s not simply sitting back and waiting for others to form markets and then hoping to jump in the fray.

Vision Pro Sales

So far, sales have outperformed expectations. Granted, those expectations were low, but Apple is believed to have sold 200,000-250,000 units in the United States so far. The bulk of analysts believed 400K units would be sold this year, so yeah, that’s a good start.

Dan Ives, known for his optimistic outlook on Apple, predicts Vision Pro sales of 600,000 units this year and 1 million by 2025. Mohan, a Bank of America analyst, has projections similar to Ives, but expands out to suggest 4 million units in 2026. All of these numbers seem reasonable, although Apple will really have to ramp up the “things you can do in Vision” pitch to convince people to part with $3,500.

However, we do have to expect that Apple will bring out a lower priced device at some point. That point would likely be 2026. How cheap? That’d only be speculation, although if I were a betting man I’d say likely not too cheap. $2,000? $2,500? Those price points would likely still allow Apple to average $3,000+ per Vision sale across the product line. And, if we do that math, it makes Vision a $15B+ market in just a few years, ~4% revenue growth for Apple.

4% is not exactly groundbreaking, it barely beats out inflation in some recent years. There’s also a good chance it cannibalizes sales from the iPad and Mac lineup too. But, again, Apple is trying to skate towards where that puck is heading and attempting to build the platform for the next decade after having clear ownership of the last.

I believe that as the years go by and this tech improves, it will be something that many choose to pick up. Apple won’t be alone in this battle for spatial computing supremacy, but they do have the clearest path to success right now.

My assumptions here are based on analysts numbers, current sales, the sales path the Apple Watch took, and a gut feeling. These are then used to drive the Apple model that’s available to Tech Breakdowns subscribers here.

- 2024 - 500,000

- 2025 - 1,500,000 (largely expanding to other nations)

- 2026 - 4,000,000 (new VP2, cheaper variant rollout)

- 2027 - 10,000,000 (cheaper variant gets some traction, platform expansion)

- 2028 - 15,000,000

Generative AI

Discussing Apple and innovation necessitates addressing an area where every other tech company is heavily invested, yet Apple appears conspicuously absent: AI.

Tim Cook did say recently that Apple would “break new ground” in GenAI, but we are still left with speculation.

Speculation has it that Apple is targeting a number of enhancements that will target iOS, macOS, iPadOS, and, presumably, VisionOS later this year. Those features will likely be lead by significant enhancements to Siri that will allow the voice-enabled assistant to answer more complex queries and handle conversations.

Apple is also rumored to be trying to get most of the processing done on device, so there’s a need to significant hardware changes, namely to the Neural Engine, for on-device AI.

For my own take here, Apple has a tremendous amount of data. The company knows where you are at all times, who you talk to, when you talk to them, what apps you use (and when), what time you wake up, what time you sleep, who’s in the room with you, your heart rate etc. etc. etc.. Or, in short, a scary amount of information.

If Apple can leverage its commitment to security and utilize this data to enhance Siri, it could significantly increase the ecosystem's lock-in effect, a move I would have previously considered unlikely.

There is, however, a fine line for Apple to walk here in deciding if these features should cost money. I think that Apple will try to segment functionality a bit here by offering new AI features for free, but then tying certain portions to an Apple One subscription. Depending on how that’s done will largely alter the outcome of Apple’s GenAI path.

One example here, and it’s a path I believe could work, is enhanced Siri for all. It’s able to have a conversation and find resources for you. A Siri agent, though, could be made part of Apple One. The agent is capable of completing tasks on behalf of the user.

You: “Hey Siri, what are some Italian restaurants nearby...”

Siri: “Here’s three that are highly rated.”

You: “Can you book me a table for 6 at 7pm tonight.”

Siri: “Sure, I’ll notify you with a confirmation shortly.”

When it comes to modeling this out financially, I have opted to keep the Services segment of Apple growing at 10% per year through the next few years. This growth is not out of line with what was reported in Apple’s Q1 2024 report, and I believe with AI features, new services for Vision Pro, and natural growth we’ll see this segment continue on to higher highs for years to come.

Putting It All Together

Clayton Christensen extensively discussed how giants fall in The Innovator's Dilemma. As a "giant," Apple might seem vulnerable to decline, but its current trajectory suggests otherwise.

But, and this is key here, those mighty fall because they’re heavily reliant upon their existing foothold and do not innovate, they do not skate where the puck is heading. In Apple’s case, the company absolutely appears to be heading in the right direction, albeit perhaps a little slow for some on the AI front.

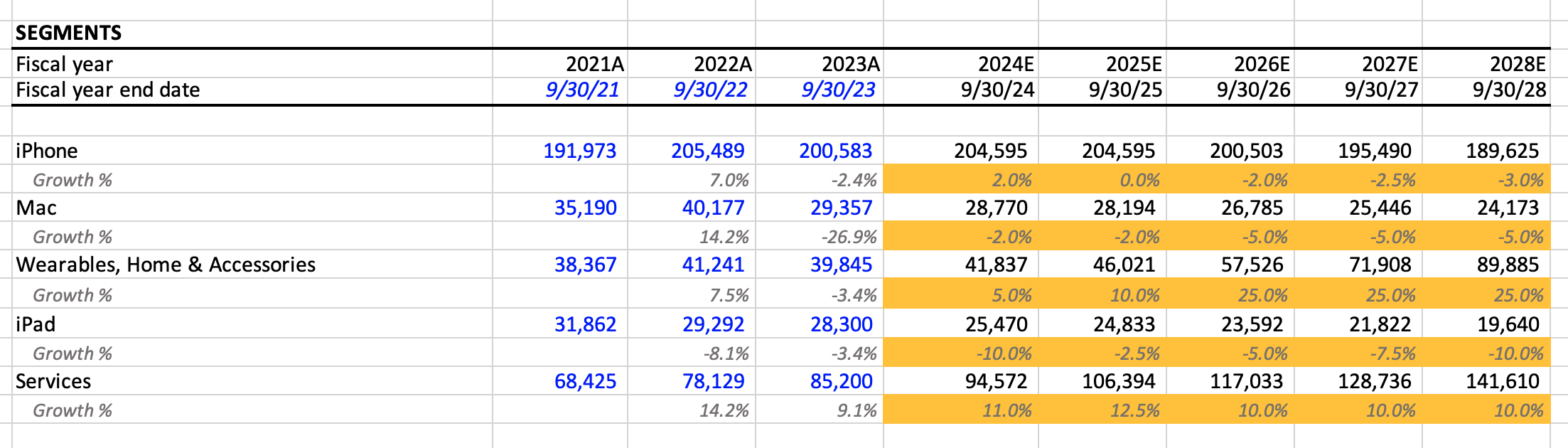

Above is what I believe to be rather fair estimates on Apple’s segments over time. We’ve already received word on the first quarter of FY 2024, so those numbers are shaped a little by that release, but everything else is speculative.

If Apple is directionally right in the bets it is making in both AI and spatial computing, then we may see Apple grow to that $4T mark at some point in the coming years.