Rocket Lab: Pioneering the Future of Space Launches

Explore Rocket Lab's impact in aerospace with its innovative rockets like Electron and Neutron. Understand its market niche against giants like SpaceX, key contracts, and growth prospects in this succinct overview.

In this article, we pivot from our usual focus on software to explore Rocket Lab, a $2.5 billion USD rocket company. We'll examine Rocket Lab's offerings, customer base, competitors, the potential for success ('bull case'), and challenges that could hinder its progress.

What is Rocket Lab?

Rocket Lab, a leading rocket manufacturer and launch service provider, has significantly impacted the aerospace industry. Beyond its primary function of manufacturing rockets to deploy satellites into space, Rocket Lab offers a range of innovative services and solutions, which we will explore further.

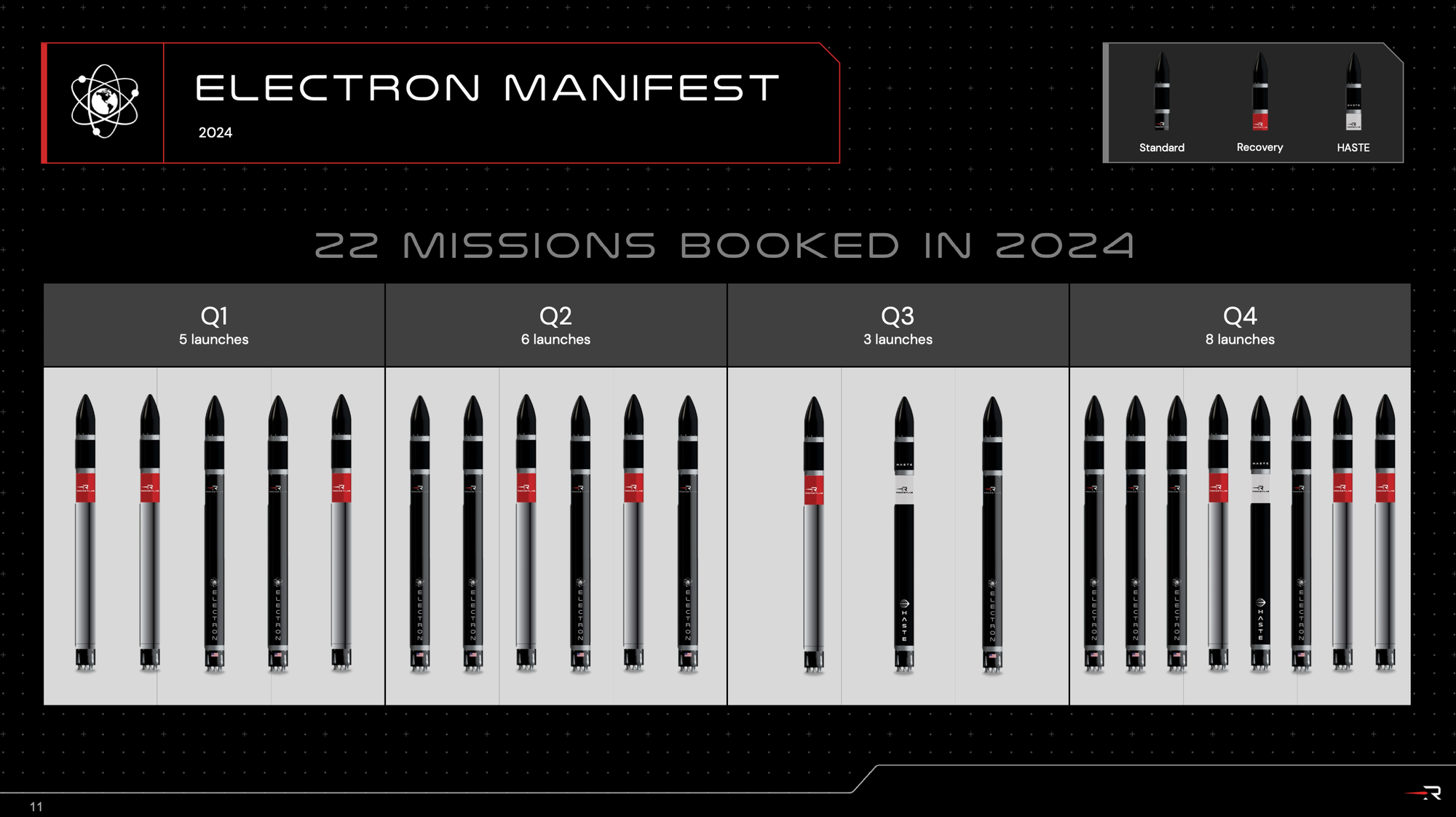

Founded in 2006 by current CEO Peter Beck, Rocket Lab has shown remarkable growth. In 2023, the company successfully launched nine of its Electron rockets, delivering satellites for various customers into different orbits, one of these missions did fail. Looking ahead, Rocket Lab aims to more than double its launches, with 22 missions scheduled for 2024.

Types of Rockets

As of now, Rocket Lab operates with a primary rocket model, the Electron, which also has a variant known as HASTE. These rockets are at the forefront of the company's current launch capabilities, each designed for specific mission requirements.

Looking toward the future, Rocket Lab is poised to expand its offerings in 2024 with Neutron coming to the market.

Let's delve into the details of these rockets and what makes each one unique.

Electron

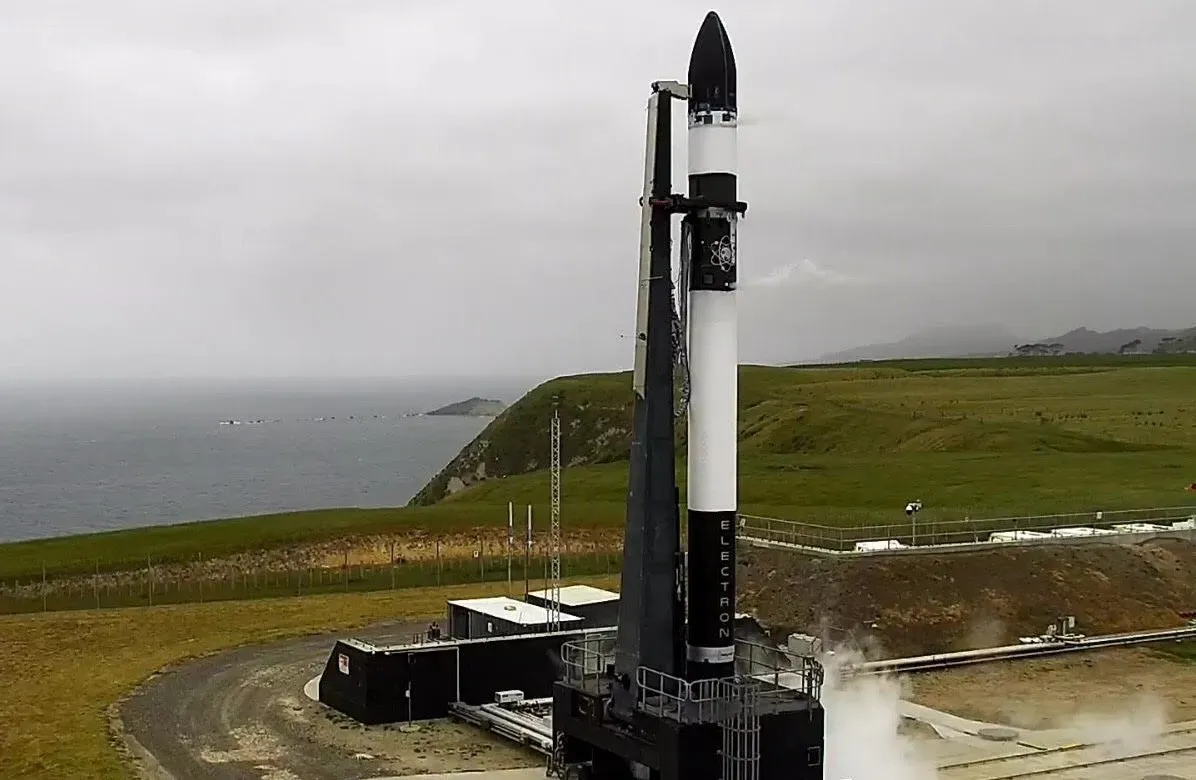

The Electron rocket has been the backbone of Rocket Lab's launches in 2023. This two-stage launch vehicle, designed for efficient separation during ascent, has a first stage that is currently being experimented with for recovery. As Rocket Lab advances, we might see recovery rates approaching 90%, significantly enhancing launch efficiency.

Equipped with nine Rutherford engines, Electron is capable of carrying 200-300 kg payloads to low-Earth orbit. These engines are notable for being predominantly 3D printed, a manufacturing innovation that saves both time and money. Additionally, they utilize lithium-polymer batteries for powering electric pumps, a unique feature that underscores the rocket's cutting-edge technology.

So what sets Electron apart from, say, the Falcon 9 of SpaceX? Well, it's designed for a completely different customer, one SpaceX can't really even accommodate.

While we'll go deeper into this in the competitors section below, it's worth pointing out here that the Falcon 9 launches 22,800 kg to LEO. The Electron, when compared, is almost a rounding error at 300 kg.

The Electron has had 40 launches so far (41 if we count HASTE), four of those were failures for some reason. With a price of around $7.5-$10M per launch, it's one of the most affordable ways to get small payloads into space.

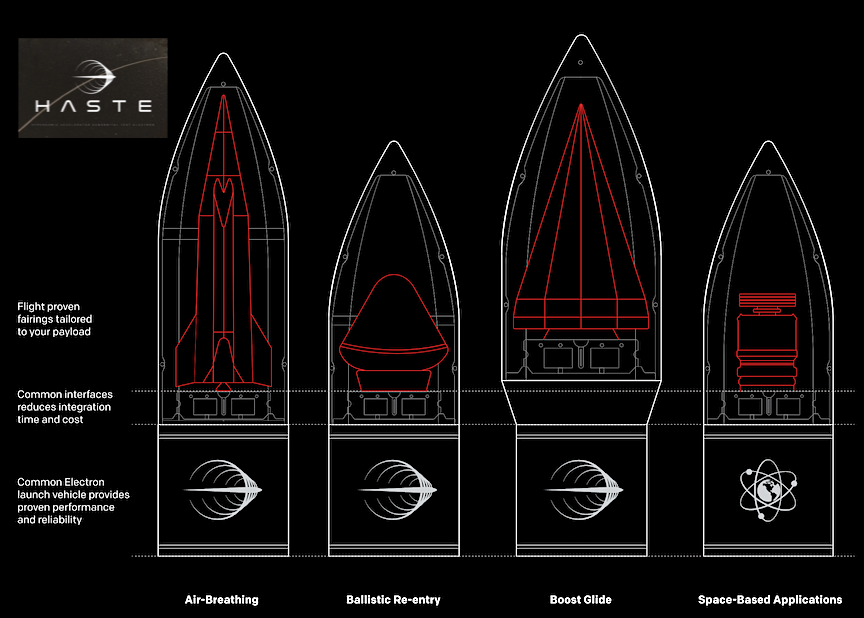

HASTE

HASTE, a derivative of the Electron, represents an innovative step forward in Rocket Lab's launch capabilities. Like Electron, it is constructed using the same carbon composite structure and is powered by the same Rutherford engines. Its distinct feature is the additional third stage, enabling it to carry larger payloads up to 700 kg, ideal for suborbital deployments. These suborbital missions are key for certain types of research and testing, where reaching space but not entering full orbit is required.

This rocket plays a crucial role in advancing research into hypersonic technologies—an area with important applications in various fields including aerospace and defense. Given its capability for high-speed, high-altitude flights, albeit not reaching orbit, HASTE is a valuable platform for experiments that don't necessitate a full orbital trajectory.

With its successful inaugural launch in June 2023, HASTE has already proven its potential. Rocket Lab expects to further this success with three more HASTE launches anticipated in 2024, each contributing significantly to hypersonic research and other specialized missions.

Neutron

Neutron, still in the developmental stages since 2021, represents a significant leap forward in Rocket Lab's capabilities. Anticipation is high for its test launches, expected in 2024, which will mark a major milestone in the company's expansion. This vehicle is designed to deliver payloads ranging from 8,000 to 15,000 kg to low-Earth orbit, depending on its configuration, significantly broadening the scope of Rocket Lab's service offerings.

One of the most exciting prospects of Neutron is its potential for human space flight, as indicated by Rocket Lab. This capability could open new avenues for Rocket Lab in manned space missions, a field currently dominated by a few key players.

In terms of cost, and I'm speculating here, we could see $25-35M per launch for revenue. This is roughly 3x the price of an Electron launch, and around half the reported price of Falcon 9 ($60-70M).

The successful deployment of Neutron could significantly enhance Rocket Lab's financial performance over the next decade. Beyond its impact on the company, Neutron's success could also reshape the competitive landscape in the space launch industry.

Space Systems

Rocket Lab's Youtube Video: Satellites At Scale

The timing couldn't have been more apt. As I was drafting this section, a video notification popped up, perfectly illustrating Rocket Lab's largest segment, Space Systems. I won't force you to watch it, but I think the title gives a good explainer of Rocket Lab's largest segment: "building satellites at scale."

"Rocket Lab" may be the company's name, but it might more aptly be called "Space Lab." Over the years, the company has evolved into a key supplier and consultant for space endeavors.

Space Systems stands as a vertically integrated satellite manufacturing firm, meaning it handles every aspect of satellite production from component manufacturing to the final assembly. Whether clients need individual satellite components or a complete satellite solution, Rocket Lab is equipped to deliver. They even offer full manufacturing services for bespoke satellite needs.

The components offered by Rocket Lab are not only space-proven but also come with the assurance of expert support. Photon, the company's flagship product in this category, serves as a satellite bus, playing a crucial role in deploying satellites and their components to their intended destinations.

In addition to hardware like star trackers, reaction wheels, and radios, Rocket Lab also provides comprehensive software solutions for planning, executing, and maintaining satellite operations. Their contribution extends to solar panels too, as exemplified by their work for NASA's Gateway space station, further highlighting their expertise and versatility in the space sector.

Competitors & Competitive Advantage

There's no need to mince words: SpaceX is the most prominent name in the space industry and naturally, Rocket Lab's largest competitor. A common query arises: 'How can Rocket Lab compete with SpaceX?' The short answer is, they don't—at least not directly. Rocket Lab has smartly positioned itself in a different segment of the market, focusing on size.

Consider the Electron rocket, tailored for 200-300 kg payloads. For a company needing to put 250 kg into low-earth orbit, options include a costly dedicated SpaceX Falcon 9 launch or a more affordable but less flexible rideshare. This is where Rocket Lab shines, offering dedicated launches that align with customer schedules and specific orbital requirements.

Similarly sized competitors like Astra, Relativity Space, Firefly, and ABL (backed by Lockheed Martin) offer similar services, but Rocket Lab's track record and focused approach give it an edge.

Neutron, Rocket Lab's upcoming vehicle, will face more competitors given its larger payload capacity. Yet, for those needing to transport around 10,000 kg to LEO, Neutron could offer a more fitting solution compared to the larger Falcon 9.

When the conversation shifts to components, the competitive landscape becomes denser. Even companies like Ball, known for manufacturing mason jars, are in the mix with products like star trackers.

Rocket Lab, however, stands out in this crowded field. Its direct experience in launching rockets provides invaluable insights into the practical needs of space missions, positioning it as a preferred supplier in Space Systems. In this realm, I'd argue Rocket Lab's hands-on expertise offers a level of trust and reliability that less specialized manufacturers might struggle to match.

Starting with the most prominent, the U.S. government, across various agencies, forms a significant portion of Rocket Lab's clientele. NASA, for instance, leverages Rocket Lab's capabilities for critical missions supporting humanity's return to the moon. In a recent development, Rocket Lab secured a substantial $515 million contract to build and operate 18 spacecraft for the U.S. Space Force, underlining its strategic importance in national space endeavors.

Outside the government sector, Varda Space Industries stands out with its novel approach to space-based manufacturing, currently focusing on producing high-value pharmaceuticals in orbit. This innovative venture not only showcases the potential for industrial activities in space but also demonstrates the utility of Rocket Lab's services in supporting such groundbreaking missions. Varda's plan for four launches with Rocket Lab, coupled with their utilization of the company's space systems segment, speaks to the versatility and reliability of Rocket Lab's offerings.

Other notable customers in 2023 included Hawkeye, Capella Space, BlackSky Global, Lidos, and iQPS. These clients leveraged Rocket Lab's technology for a variety of missions, ranging from earth observation and data collection to specialized research, further showcasing the company's ability to cater to a wide range of space-related needs.

Bull Case

The bull case for Rocket Lab hinges significantly on the success of its launch segment. While this segment might not be the largest revenue generator for the company, its role in maintaining public interest is crucial. High visibility and brand recognition can translate into lower sales costs and a natural customer inclination towards Rocket Lab's offerings.

In the launch market, Rocket Lab has carved out a niche with its Electron rocket, catering to small satellite deployments – a market SpaceX has largely overlooked. This specialization gives Rocket Lab a competitive edge.

Looking ahead, the introduction of Neutron will see Rocket Lab closing the gap in market coverage, still focusing on areas less attractive to SpaceX. The scheduled increase in launch volume from 9 in 2023 to 22 in 2024, compared to SpaceX's 98, indicates significant growth potential.

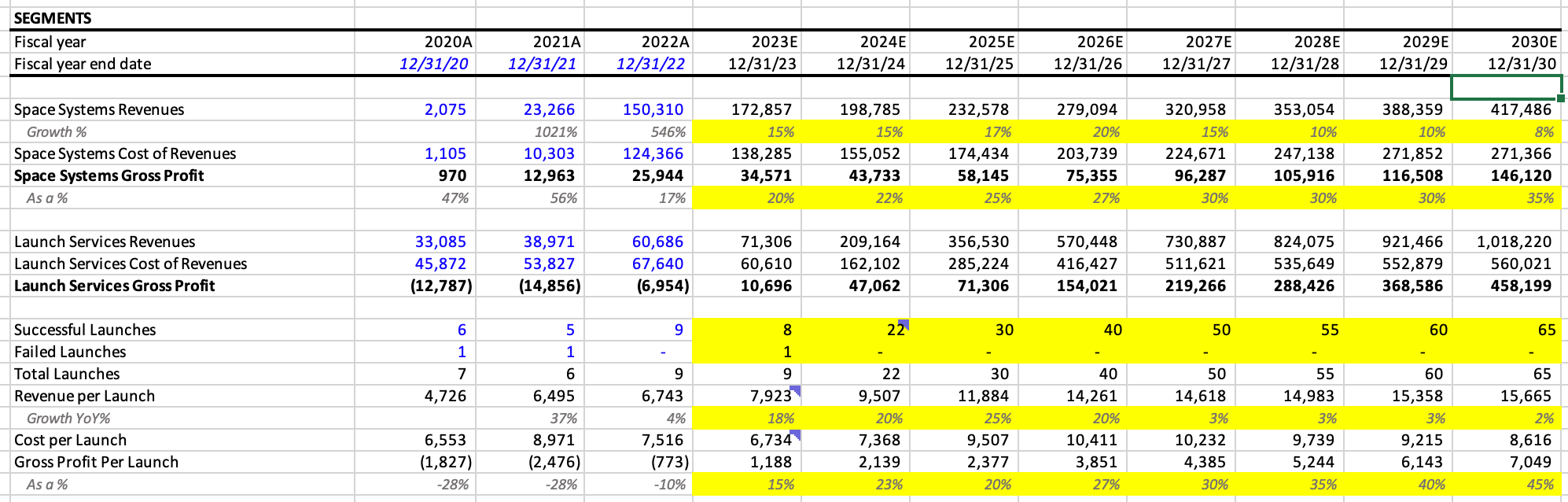

In my model, Rocket Lab's starts to approach profitability at around 55-60 launches annually, with launch margins improving to 45% due to reusability. While these figures are speculative, they represent a realistic trajectory based on current trends.

The launches themselves serve as effective marketing for Rocket Lab's Space Systems segment, which is projected to grow by 15% this year. In my conservative estimates, I anticipate this growth to increase modestly in the following years, reaching 20% in 2026 before stabilizing.

This conservative growth approach reflects the inherent uncertainty in the rapidly evolving space industry. The future landscape in 2030 is unpredictable, with technological advancements and new discoveries potentially reshaping the market.

Take Varda Space Industries, for instance. If their ambitious manufacturing goals necessitate frequent launches and extensive use of Rocket Lab's services, it could significantly exceed my current projections. The emergence of numerous companies like Varda could dramatically alter the industry dynamics, positioning Rocket Lab favorably to capitalize on these new opportunities.

Why would the bull case fail?

While Rocket Lab shows promising potential, several factors could derail its trajectory towards success. Understanding these risks is essential for a realistic assessment of the company's future.

A primary concern is mission failure. In the space industry, reputation is paramount, and even a single failed mission can have long-lasting effects on customer trust and company credibility. In extreme cases, regulatory bodies like the FAA could intervene, impacting Rocket Lab's ability to operate in key markets.

As an international entity, Rocket Lab faces unique geopolitical challenges. The launch of HASTE, aimed at advancing hypersonic technology, has already raised concerns with the New Zealand government (update 1/13: this was an assumption that I cannot back up - thanks to lukasm.3734 on YouTube for calling it out). While currently a low-risk issue, differing governmental perspectives could pose significant operational hurdles in the future.

Costs present another uncertainty. The space industry's novelty means there are few benchmarks for predicting future cost structures. The question remains: will rocket launches become a commoditized service, or can Rocket Lab sustain high gross margins of 40-50%?

Lastly, market saturation poses a considerable risk. The possibility that the demand for communication satellites reaches a peak, or that manufacturing in space proves less viable than anticipated, could significantly impact both the launch and space systems segments. Such a scenario could challenge Rocket Lab's sustainability and growth.

In essence, while Rocket Lab has a solid foundation and a clear growth path, these potential pitfalls underline the importance of strategic agility and market responsiveness in the ever-evolving space industry.

Valuation

As always, paid subscribers to Tech Breakdowns can access the detailed model (and any updates) on the models page.

In my financial modeling of Rocket Lab, I've adopted a very conservative yet optimistic approach. While I'm not projecting an overly bullish scenario of Rocket Lab dominating the launch market with 200 launches by 2030, I do foresee substantial growth.

According to my model, Rocket Lab's launches are projected to increase from 22 in 2024 to 65 by 2030. This growth is aligned with the industry's trajectory and Rocket Lab's focus on small and medium-sized payloads. The average revenue per launch is estimated at $15.5 million, a blend of Electron's $7-8 million and Neutron's $30-50 million. With a 45% margin driven by reusability, this could translate to $7 million in gross profit per launch.

For the Space Systems segment, a steady 15% growth rate is projected for 2023, continuing into 2024. A slight increase is expected in 2025 and 2026, likely driven by additional systems sold alongside Neutron launches, before moderating again. The aim is to be realistic, estimating this segment to grow to $417 million by 2023.

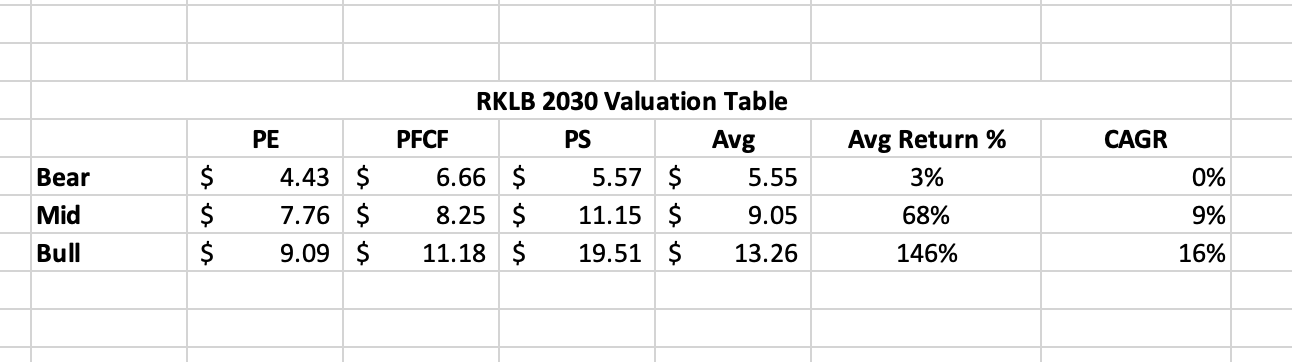

For a more detailed breakdown of these projections and their implications, check out the accompanying YouTube video linked above. All factors considered, I value Rocket Lab at $9.05 per share in 2030 at the midpoint, representing a 68% growth from today, or a 9% CAGR.

While this is a more conservative estimate, the potential for higher growth exists. A more bullish scenario could see a 16% CAGR through 2030, reflecting both the opportunities and risks inherent in this rapidly evolving industry.

Summary

My deep dive into Rocket Lab while writing this piece has not only increased my appreciation for the company but also solidified its place as a core subject of coverage here on Tech Breakdowns.

Rocket Lab undoubtedly has the potential to grow into a significant player in the space industry, which itself is projected to expand to $1 trillion by 2030. The company's future, however, hinges on two critical factors: the overall growth of the space sector and Rocket Lab's own strategic execution.

CEO Peter Beck, a notable and inspiring figure in the industry, has been instrumental in steering Rocket Lab to its current standing. His vision and leadership will be pivotal as the company navigates future challenges and opportunities.

Investing in Rocket Lab, like any venture in this innovative yet volatile industry, comes with its risks. The space industry's inherent uncertainties mean that investors need to brace for potential fluctuations. Nonetheless, the prospect of substantial rewards, should Rocket Lab capitalize effectively on the industry's growth, presents a compelling case for potential investors. This balance of risk and reward is a quintessential aspect of investing in frontier technologies, where the potential for groundbreaking success often coexists with the risk of setbacks.