Unity: Analyzing the Evolution, Challenges, and Future Prospects of a Game Engine Giant

Unity, a $13B company, thrives in game development with its easy-to-use engine, diverse revenue streams, and plans for future growth under CEO Whitehurst.

This week, we’re breaking down a company that I’ve personally followed for a long time, Unity. We will take a peek at what Unity does, what the customer base looks like, how those customers pay for the product, and we’ll close things out with what the future of Unity might look like.

First, a quick primer on game engines. Understanding what they are and why they are used is vital to understanding Unity as a business.

Game Engines: A Primer

"Don't reinvent the wheel" is a popular idiom used in all walks of life, and, well, it sums up what a game engine is.

When making a video game, there are lots of foundational things one must consider. Things like gravity, or how a bullet flies, or even the basic controls of the game.

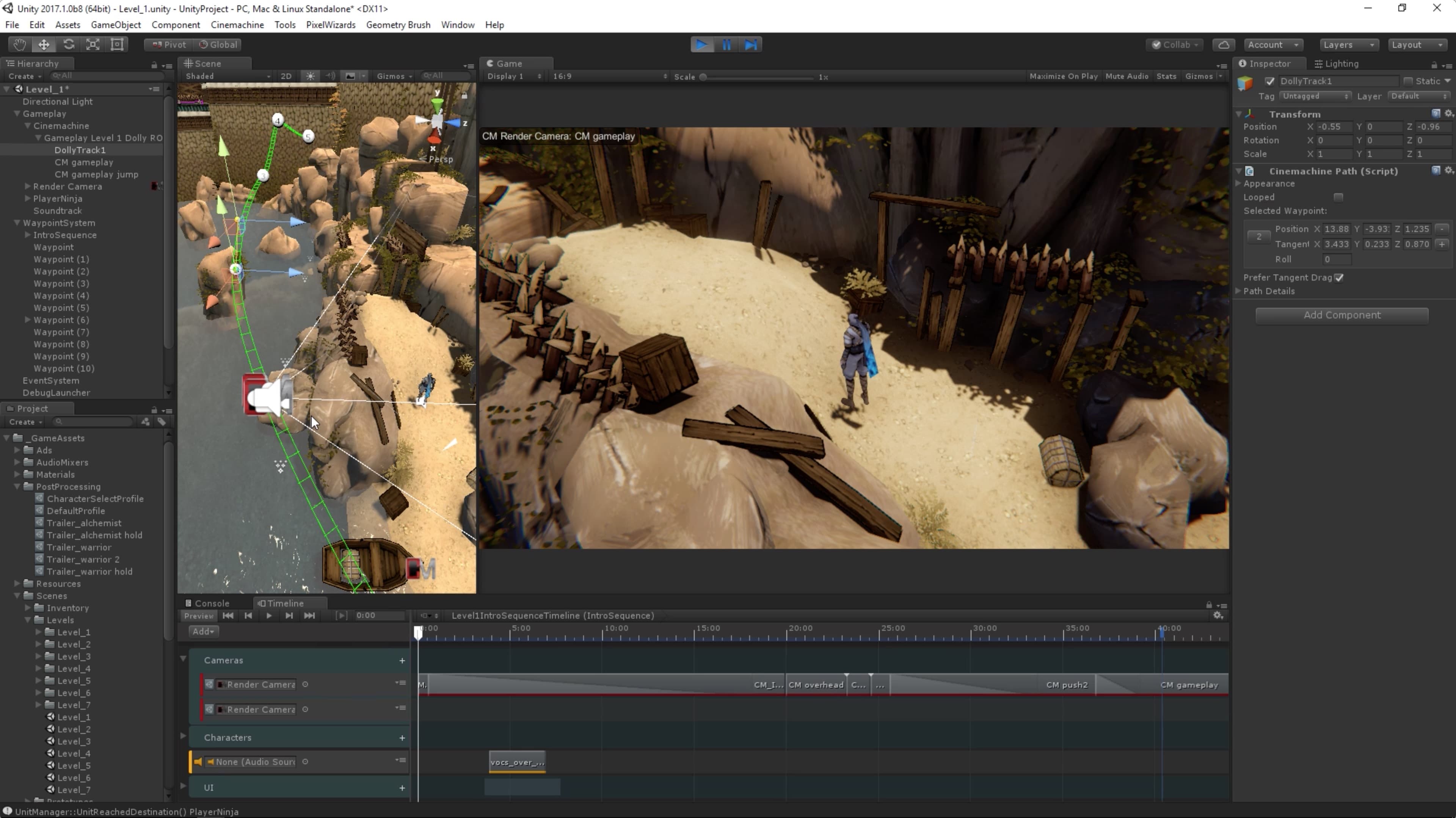

A game engine brings these common elements together to simplify development. So, rather than try to define gravity and how quick a player or object should fall, you utilize the game engine's built in physics properties. And rather than try to write the code for rendering graphics (a very difficult task), you utilize the foundation the game engine has built.

In short, a game engine is a tool designed to streamline and simplify the game development process.

Game engines are useful and used by many because they save time and resources by providing ready made components that developers can use and customize. They're also incredibly consistent, allowing people to hop into projects and understand how they work (assuming they're using an engine that developer is familiar with). And, finally, game engines also make it easy to deploy games to multiple platforms with ease.

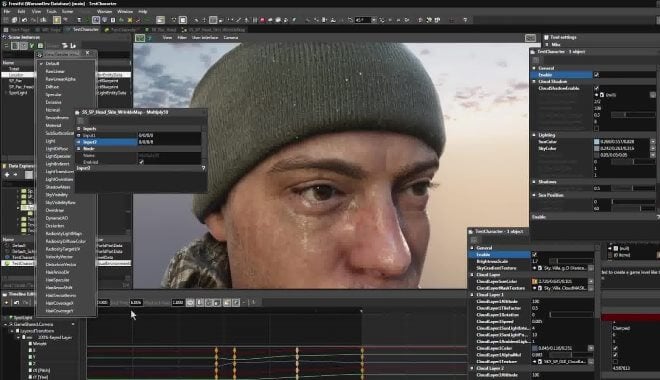

Game engines typically fall into one of three categories. First, you have the commercial engines. These are the type we'll be discussing in this article. Unity is a commercial engine, as is its major competitor Unreal Engine.

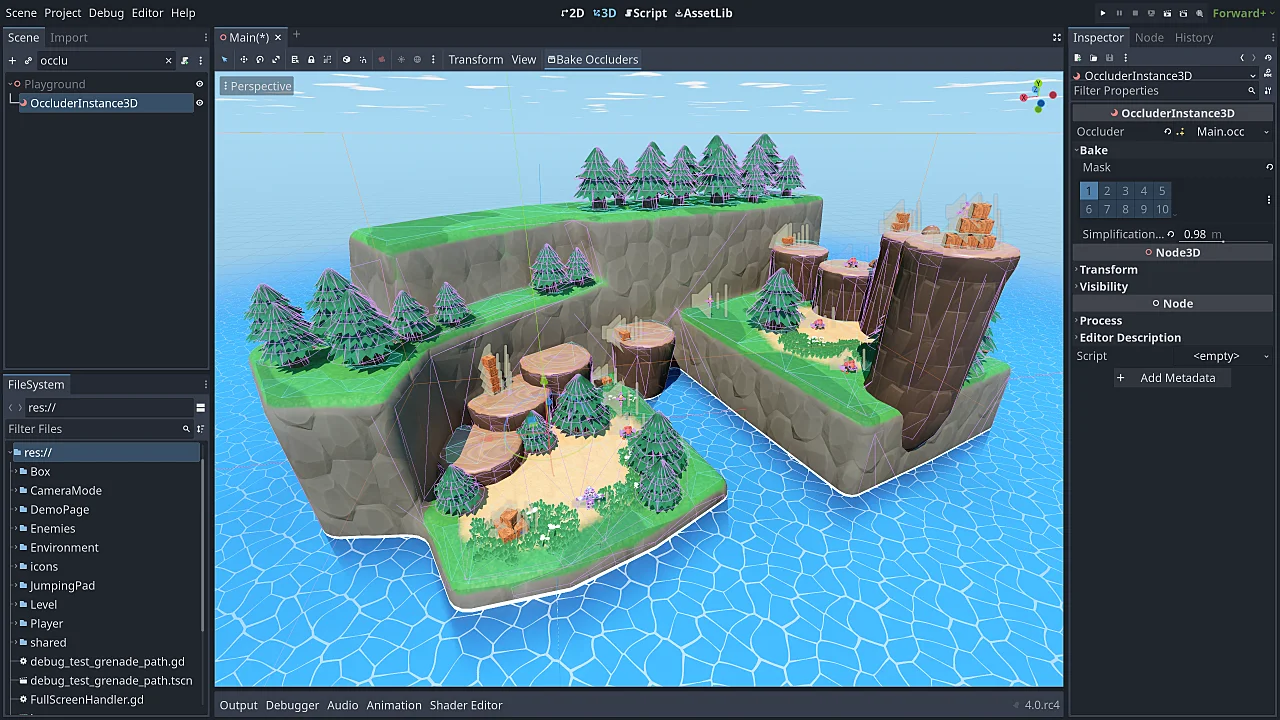

Second, and also competitors to the commercial engines are the open-source engines. The most popular among the open source names is Godot.

Third, is homegrown - or custom. Some developers enjoy the challenge and will build a tailored solution for their specific needs. Some companies (like Activision or EA) have massive budgets and build their own engines to gain a competitive advantage.

When selecting a game engine, engineers typically consider the project size, budget, and technical requirements. We'll definitely cover this throughout, but it's likely that a team building a mobile game selects Unity, while a team looking to build for the PS5 chooses Unreal (barring creating a custom engine).

A final note to say that these engines are consistently getting updated. You'll frequently see cutting edge updates announced by Unreal Engine, and new functionality from Unity like VR / AR compatibility and AI features.

What is Unity?

Unity was founded in 2004 (the name came about in 2007) by David Helgason, Joachim Ante, and Nicholas Francis. The trio initially built Unity as a game engine for their own game, but it soon evolved into a universal game development tool.

Fast-forward 20 years and Unity is a publicly traded $13B company that has grown to earn revenue of approximately $1.4B annually.

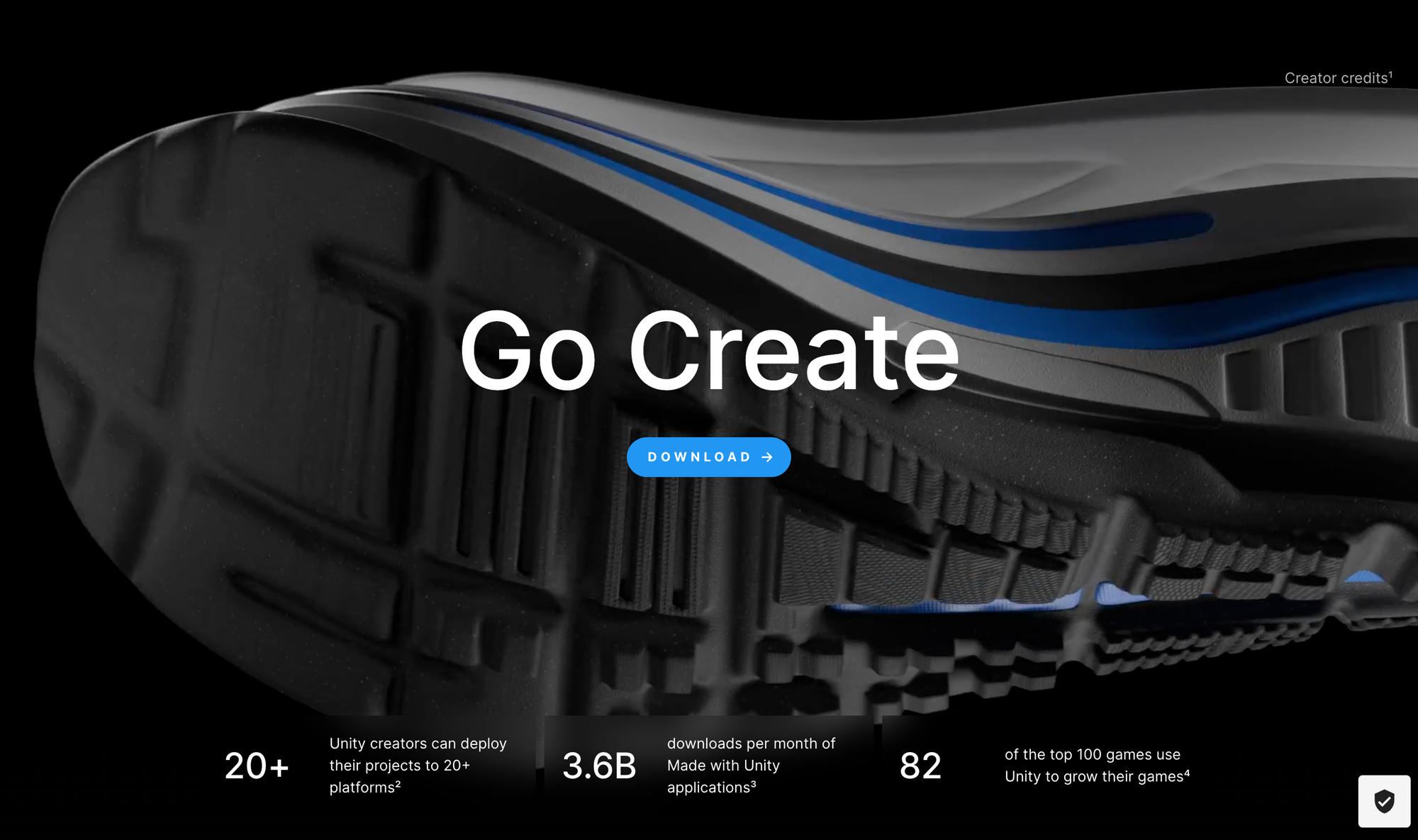

The Unity engine is the company's flagship product. It's known for being easy to use, well documented, and has a fantastic, thriving community of game developers. The engine is free to download, and free to use. After reading this, you could go make your own game and never spend a dime on Unity unless you earn over $100k in 12 months.

This approach, the download it for free and give it a try, this is what really put Unity on the map. It was a commercial offering, backed by a company, that only wanted to charge you money once you were successful. This decision led to many trying and learning game development with Unity due to the lack of barriers to entry.

Other game engines also use this approach now. Unreal Engine is free, although not quite as easy to work with. Open source game engines too, by their nature are free. Again, though, they're not as simple as Unity to get started with, and they absolutely lack the decades of community involvement that Unity has had.

Today, Unity claims that 82 of the top 100 games (on iOS and Android) use Unity. The company also says that applications made with Unity are downloaded more than 3.6 billion times per month.

That word there, "applications," should cause an eyebrow raise too. Unity over the years has branched out to more than games. The tooling is also used in film production and industrial use cases.

On the industrial front, "digital twin" allows for businesses to create a virtual copy of a physical asset. The twin can then ingest data and allow engineers, or manufacturers to interact with the processes in a virtual world. Digital twin has use cases in architecture, engineering, construction, energy, retail, and manufacturing, just to name a few.

On the film front, Unity's Weta Tools allow for 3D creation, simulation, and rendering of immersive virtual worlds. Per the company's own use cases, the tooling was used in Avatar 2 - a very immersive film if you've seen it.

How Does Unity Make Money?

Unity, as alluded to earlier, is free-to-use, but it's not free forever. If your company makes over $100,000 in a 12-month period, you'll have to pay licensing fees.

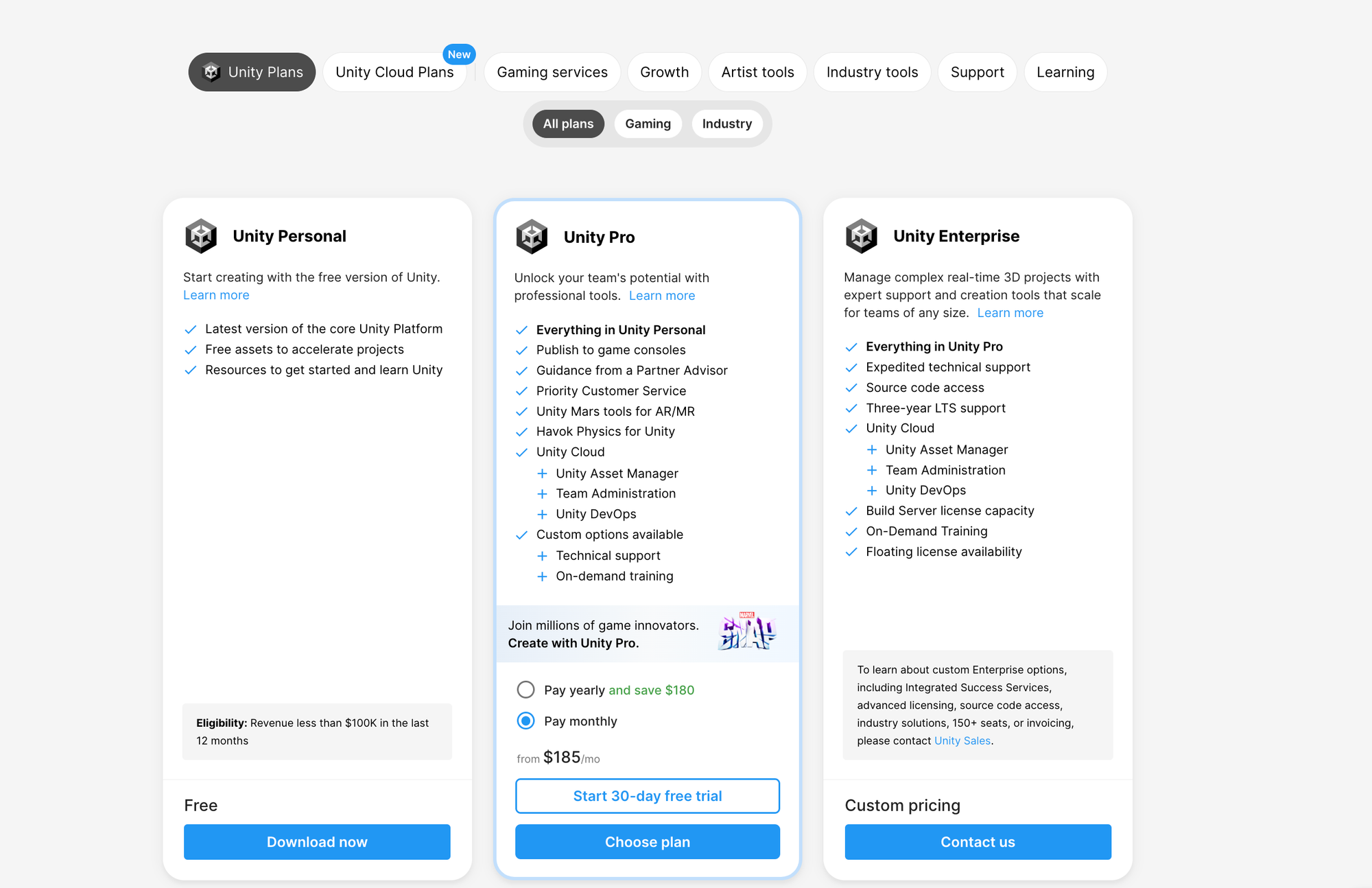

So let's start there as Unity's primary source of income is the sale of these software licenses. These licenses cater to individuals, small teams, and large enterprises. As is common in software subscriptions, those tiers offer varying features, and support structures.

Unity has an overly complex pricing system, in my opinion, and I think it'd be beneficial to clean things up a lot. For the time being, just know that pricing starts at $185/month and goes up to $450/month before you have to start going the "Enterprise" route.

Outside of subscriptions to the software, Unity does have a number of other business lines that provide income. Of note, the company does not break these out into segments, operating as a single segment so it can be tricky to gauge how much of a contribution each of these groupings is to the broader business.

First, the Asset Store. Developers can buy and sell assets like 3D models, textures, tools, and scripts. Unity makes money by taking a 30% cut on the sale.

Second, Unity Ads and In-App Purchases. Unity earns revenue here by taking a share of the advertising revenue for ads shown in games, and by taking a portion of in-app purchase revenue.

Finally, among the larger items, there's educational and training services. Unity offers a lot for free, but the company also offers paid training solutions too.

The "among the larger items" line is needed in Unity's case as the company does have a lot, and I mean a lot, of ancillary tools. In gaming alone there is Relay, Lobby, Cloud Save, Matchmaker, Analytics, Chat, Friends, and I'm rambling at this point.

In industrial uses there's Pixyz, Unity Simulation, Muse, and Build Server.

Every one of these products has its own use case and its own pricing. This makes things incredibly complex both from an operations standpoint, and from a customer understanding point of view.

Tying nicely into our next section though, I will leave you with a quote from the company's Q3 earnings letter where new CEO, Jim Whitehurst, clearly indicated the company was looking to fix this:

This leads me to believe that we have a significant opportunity to accelerate revenue growth, improve profitability metrics and increase free cash flow generation going forward. However, we are currently doing too much, we are not achieving the synergies that exist across our portfolio, and we are not executing to our full potential. We aim to address these opportunities to emerge as a leaner, more agile, and faster growing company. We will share specifics as plans are finalized over the next few months.

The Future of Unity

The quote used to close out the last section, along with a handful more in the Q3 letter give us a rather clear picture of where Unity is heading in the near future.

Whitehurst, who was previously CEO at Red Hat, recognizes that Unity’s product vision was left unchecked. New features were added, new products were made. While it’s difficult for us to know exactly how well each product sold, it stands to reason that many of them were simply “inventory,” collecting dust and taking up employee time in sales and maintenance.

While the plans Whitehurst referred to still have not been released, I imagine we saw the start of them with the recent cut to the workforce. Unity plans on letting go 1,800 employees, or roughly 25% of the team.

Unity will announce its Q4 and full fiscal year 2023 results on February 26th. I’d expect this call to contain a lot of detail on the plans for FY24, likely followed by an investor day containing even more details.

Based on all that’s been said and done so far, my expectation is that Unity will return to its roots a little more. Simplifying offerings, making the market well-aware of what’s offered, and being a company the community trusts.

The latter will take a lot of time. With changes to the pricing model last year that aimed to charge developers per download, there was plenty of outcry. The company has cleaned that messaging up, but there’s still a perception of Unity being a company that doesn’t care about its users in the tech scene (letting go 1,800 employees will compound this).

Assuming that time does heal these wounds, Unity will remain one of two viable non-custom options for building a commercial game. Godot could get there over time, but today the open-source engine does not stack up, at all, versus the likes of Unity and Unreal.

Continuing on as a duopoly, Unity will be looking for growth in the Apple driven resurgence of AR/VR. The company’s toolset allows developers to build titles that take advantage of Apple’s upcoming Vision Pro headset. Should Vision Pro be a commercial success, Unity stands to gain there.

Unity will likely also continue trying to blur the lines between what it offers and what developers get from Unreal Engine. Unreal, as it is today, is the choice for AAA-developers. The massive games that aren’t built on custom engines use Unreal. Unity, while unlikely to ever nab those massive titles, will likely try to move a little upmarket over time.

That move upmarket, to me, is misguided and I hope that part of Whitehurst’s plans include an avoidance of this. Focusing on their core - the indie, mobile, and smaller scale developers - will lead to faster reputation rehabilitation. Chasing the big names may well further alienate the core user base.

Unity's Bull Case

The bull case for Unity starts, rather simply, with competition. If you want to build a game you have to either reinvent the wheel or choose a game engine. Your choices there, especially if you’re serious about making a game that can be released to players are Unreal, Unity, and to a lesser extent, Godot.

This, then, is a duopoly and Unity would have to really mess up to lose the market position it has attained. The company owns the engine of choice for 70% of mobile games and likely over 50% of the current AR/VR market. The good thing about both of those markets is that they're growing at a really good rate.

Mobile games, per Statista, are estimated to generate some $98B in revenue in 2024, growing at a CAGR of 6.39% through 2027.

The VR market is also growing, and faster. It's estimated that VR will grow at close to 25% annually over the remainder of the decade. Sure, not all of this is going to run into Unity's income statement, but the growing industries sure are a positive sign.

While growth in gaming is a positive sign, it's worth noting that the firm also has great differentiation of customer base. Roughly 25% of Unity's revenues come from non-gaming - primarily from industrial uses. Think architecture, or even companies like Honda.

The software Unity makes can be utilized far outside gaming, and this could, in addition to gaming, be a big growth market in the future. In fact, the company is sat at the center of many digital trends like AI, XR, the Metaverse, robotics, and digital twins. Any one of these could be a big boon to the business.

The new CEO is a product-focused CEO. This is what the company needs. While it's going to be in the next section a little more, it should be called out that former CEO John Riccitiello, in my opinion, put monetization above product. That will not and cannot work long-term. Whitehurst adds to the bull case by focusing on product.

Finally, Apple's Vision Pro is a part of the bull case. While the Vision Pro seems to be falling flat in terms of all-around buzz from the public, it could end up being a massive technical shift, and Unity offers developers a toolset to build upon the Vision Pro.

And What Prevents The Bull Case

The largest risk facing Unity is one that's already well in motion, and that's the focus on monetization over product.

It's worth noting right up front that this could be changing. Former CEO John Riccitiello came from EA where he had nickel-and-dimed customers into EA being recognized as one of America's worst companies. That nickel-and-diming didn't stay at EA though, it traveled with him.

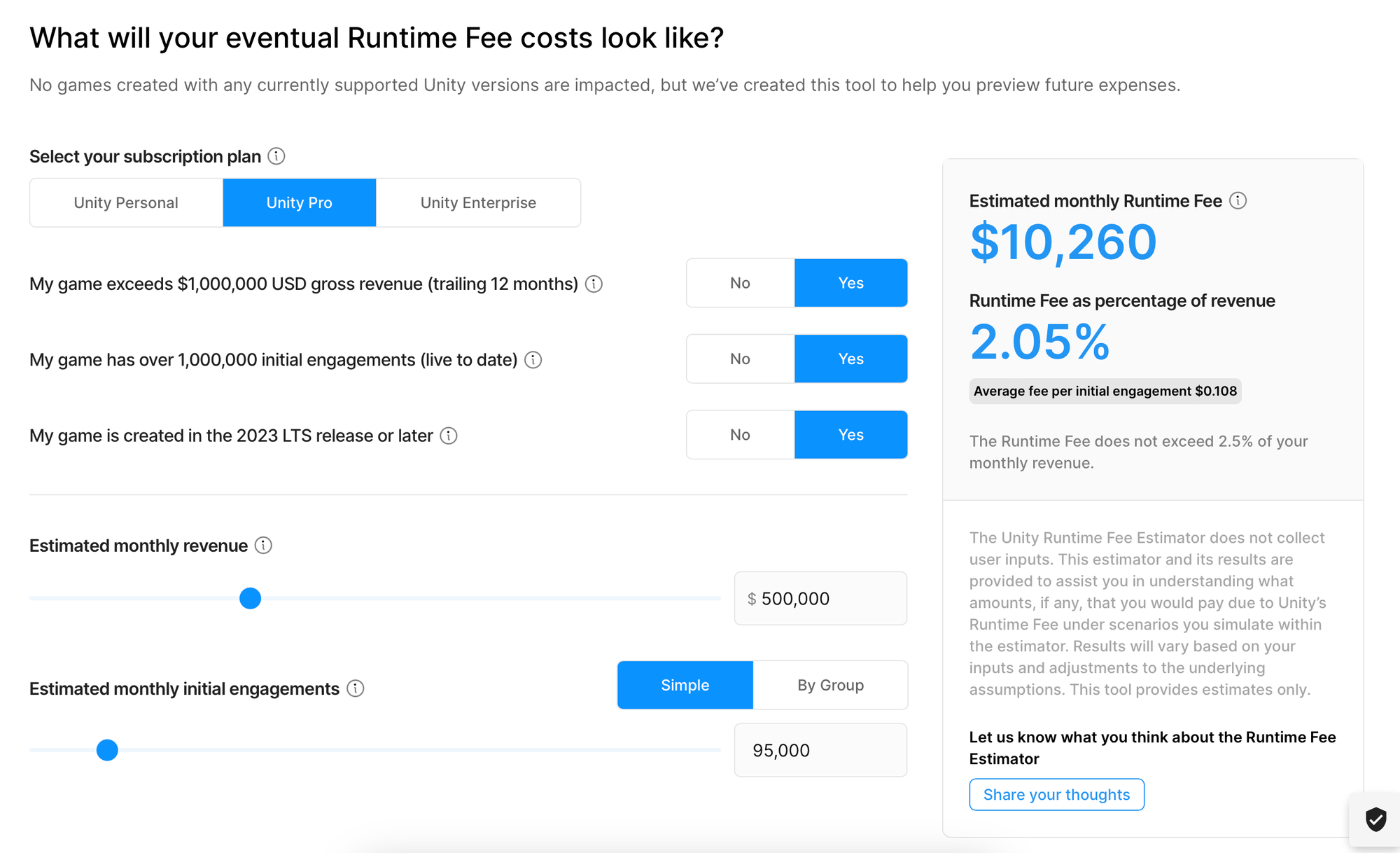

The most "famous" instance of this, and perhaps the biggest fall from public grace I've ever seen came on September 12th, 2023 when Unity announced runtime pricing.

The announcement came with little context, showing that some developers could be paying 10-20 cents every time someone installs their game. This, especially for a free-to-play game, is essentially a death sentence.

Unity has since provided much more information around this change, but it still remains. It also is still relatively complicated, so complicated that you need the calculator pictured above to begin to estimate your costs.

I believe the company needs to flip the script and begin focusing once again on product over profit. Given they're operating in a duopoly, a fantastic product will lead to returns downstream. Nickel-and-diming up front just pushes potential customers further away.

It's been mentioned throughout the article, but I believe Unity has an uphill battle to climb to regain public perception. The company has had layoffs multiple times over the past couple of years, there's the aforementioned runtime fees, and another recent massive layoff has Unity looking like a company one need not get involved with.

Time, of course, does heal all wounds. Unity benefits from the duopoly in that there's not many places for developers to turn. When you combine that with the lock-in effect of knowledge (re-learning a new environment isn't quick), then Unity might heal faster than most. That said, the company will have to make sure it's not consistently putting negative news out into the world in 2024. They'll need some positive outcomes this year or this name might continue circling the drain.

Financials

Given the nature of Unity, instead of trying to fully model this business going through turbulent times, I've instead decided to focus on reviewing KPIs. A stripped / scaled back model is then produced with this data.

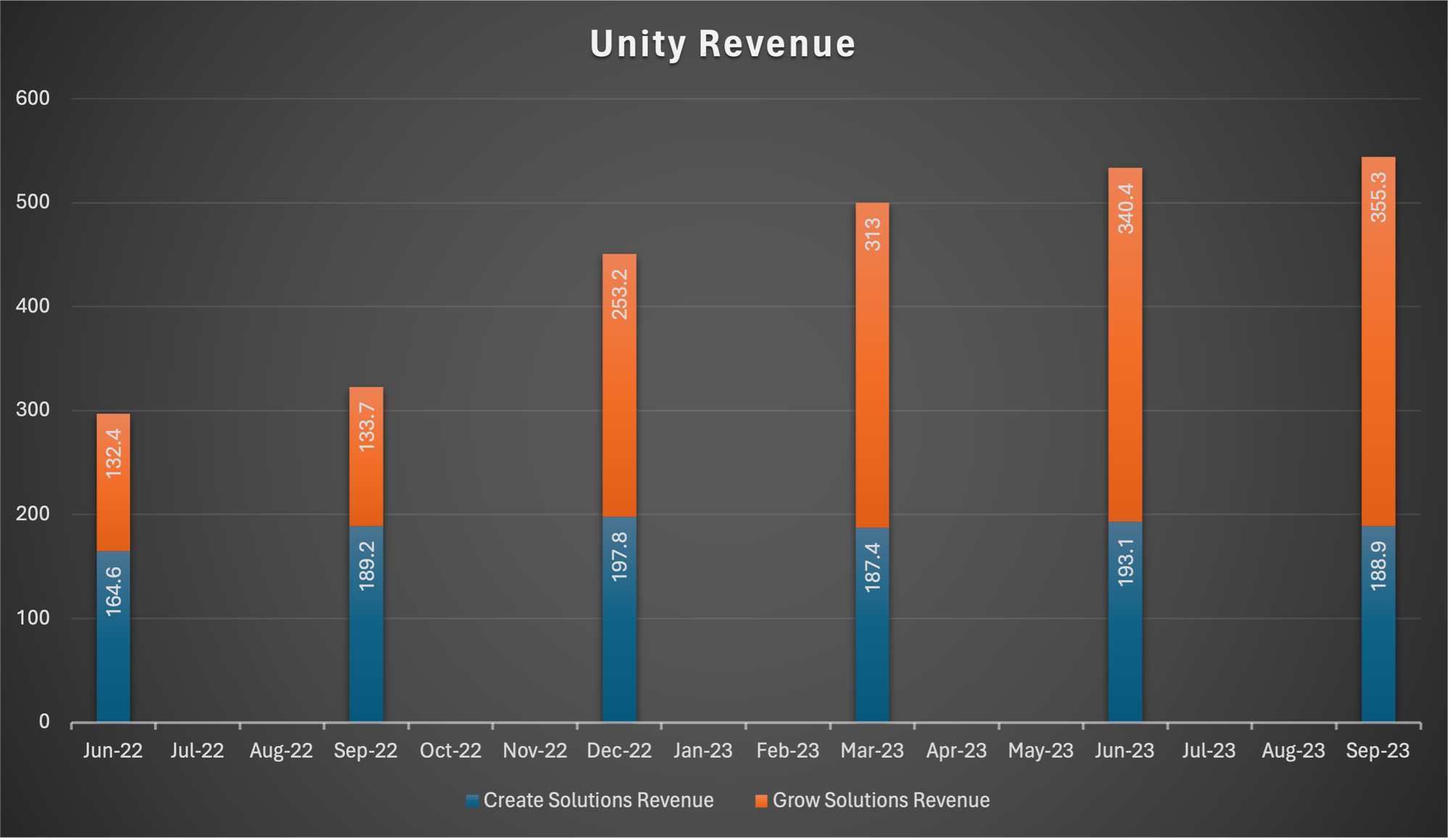

We'll start with the biggest, and most obvious bucket, revenue. Unity breaks revenue into two buckets shown above: Create Solutions and Grow Solutions.

First, Create Solutions which is where the subscription revenue goes. This is subscribers to Unity's tooling and cloud based creation services.

The second bucket is Grow Solutions. Grow is where you'll find revenue from Unity's monetization solutions, user acquisition offerings, and other similar offerings.

As you can see from the revenue chart a little further up, Grow Solutions has really taken charge over the most recent period at Unity, and that's likely to continue into the future.

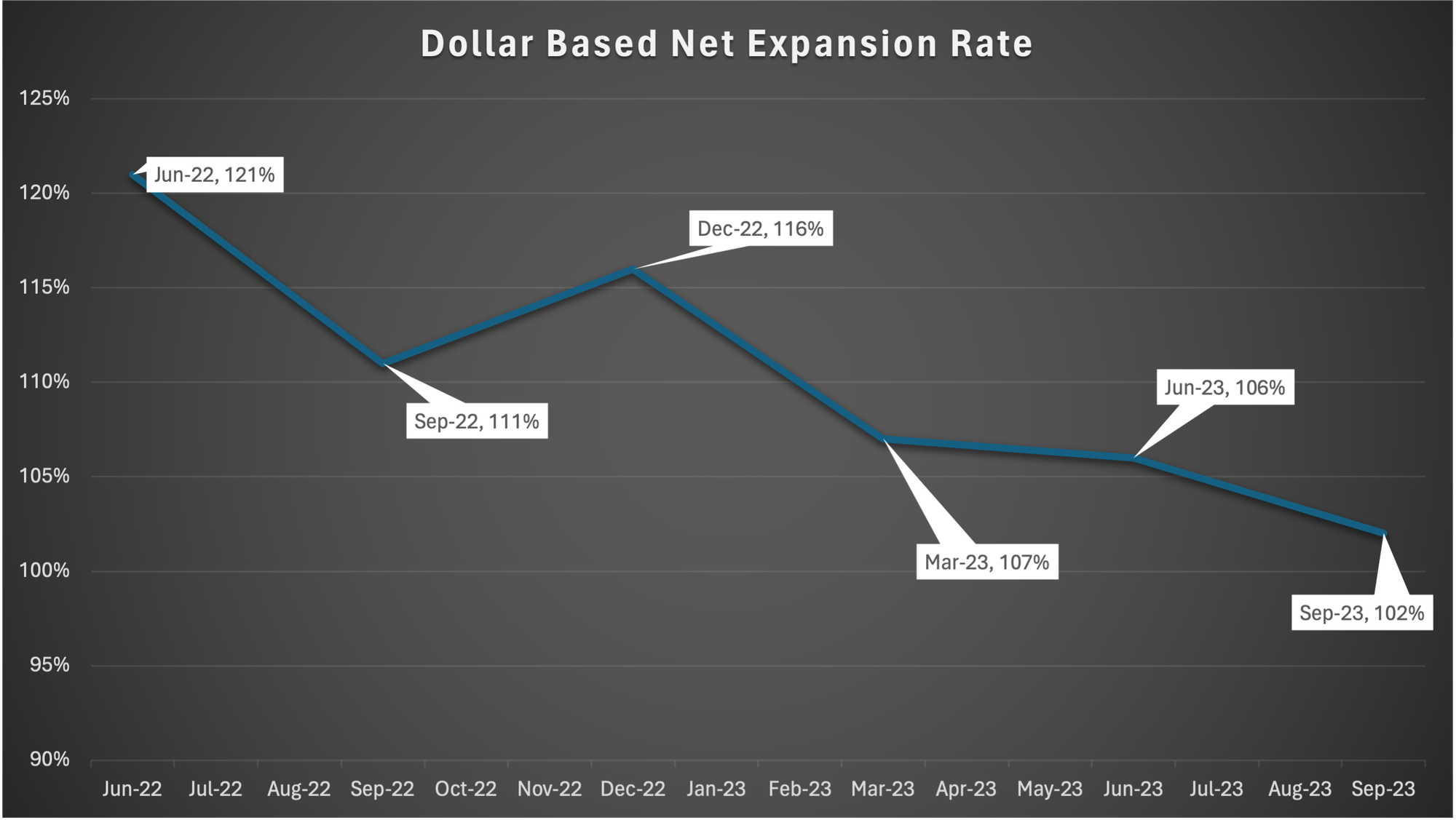

Turning to the KPIs, this is where things do get a little alarming in my opinion. Let's look at dollar based net expansion and large customers.

Dollar based net expansion "measures the ability to increase revenue generated from the existing customer base." In short, how much would revenue grow if no customers churned or signed up.

All-star software companies like Snowflake woo investors with 130%+ in this domain, and Unity used to do that too. It has, however, since fallen from those graces.

Last quarter, the company reported a dollar based net expansion of just 102%. Yes, it's growth, but the chart above doesn't make it look like it'll be growing for long.

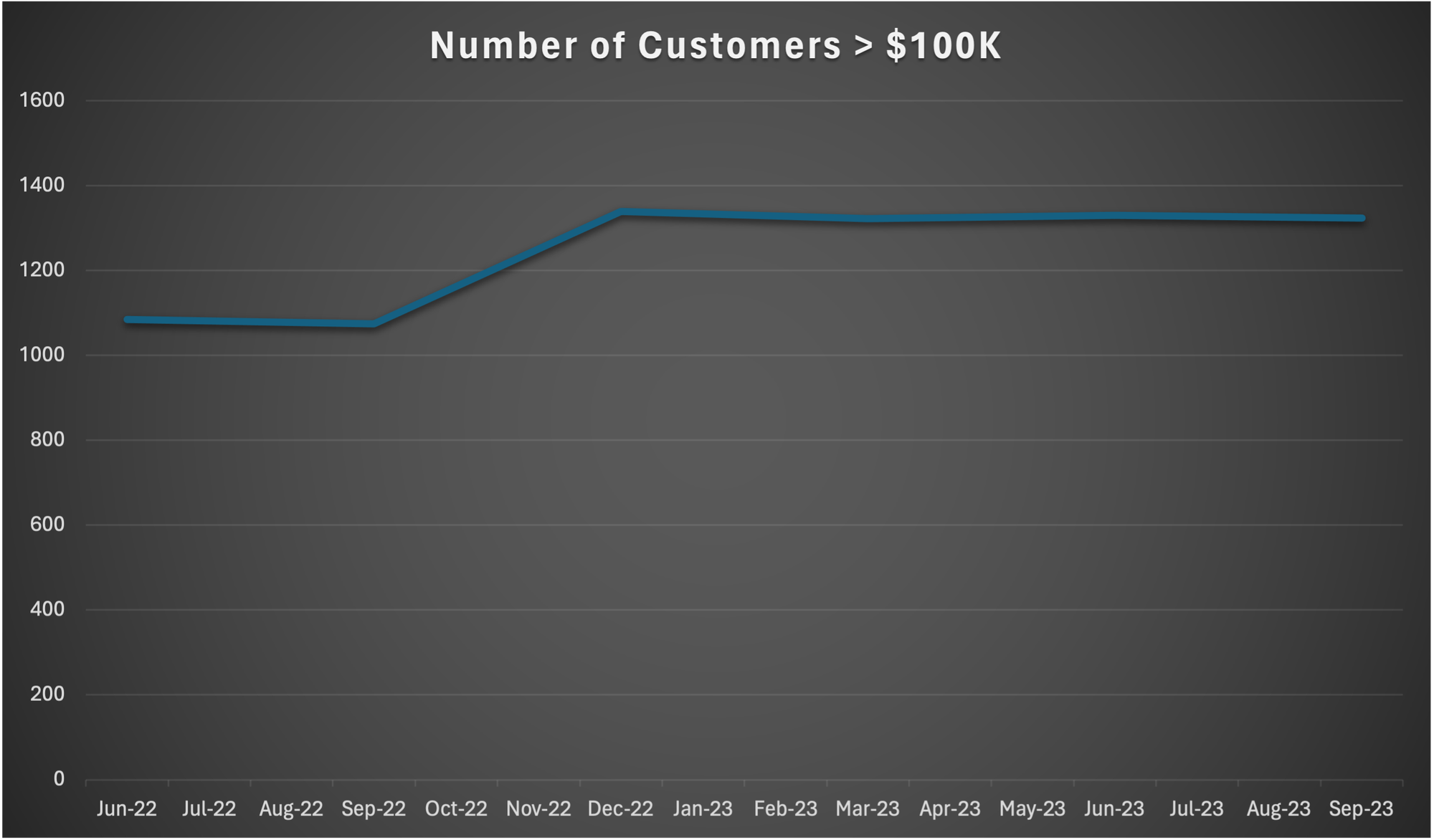

On the customer's front, Unity has 1,324 customers contributing over $100k to revenues. While this number is up from mid-2022, it has plateaued in 2023. Thinking back on what we wrote above about a lack of confidence from customers, it will be interesting to see if either of these KPIs remain happy during the Q4 / full-year earnings release.

Analysts

Analysts are, as expected, rather mixed on Unity. Price targets range from $16 all the way up to $55 with the midpoint being right around where Unity trades today.

The problem is that you can see Unity going in any of these directions with ease.

If the damage was done by Riccitiello and customers do end up parting ways then $16 could be right around the corner. If things remain a little flat and Whitehurst has a good plan for 2024, then $55 could be easily reached on sentiment and market positioning alone.

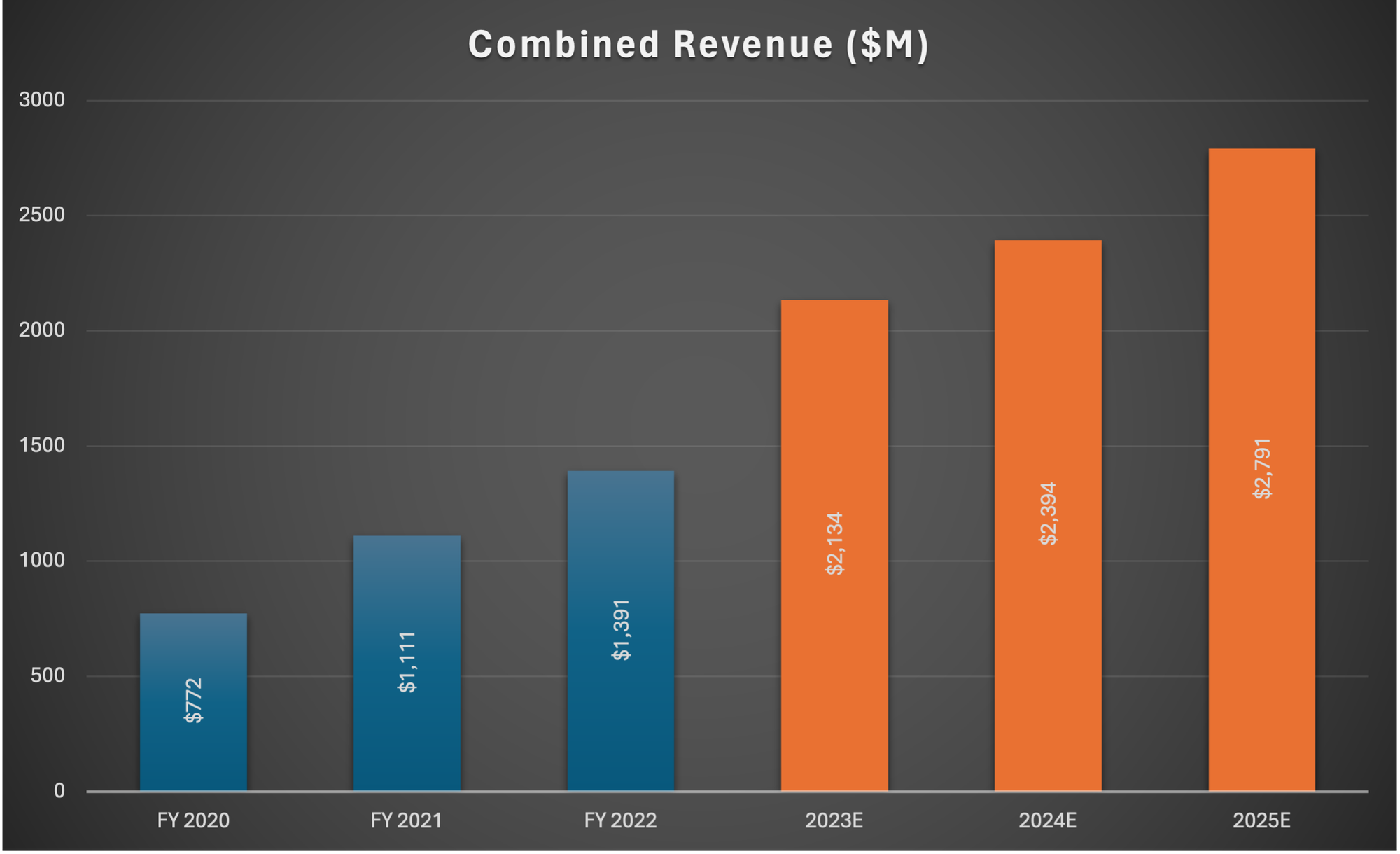

Revenue estimates on the business have been added to the chart above, and they're available in the downloaded data. Analysts expect the company will close out 2023 with $2.1B in revenue (mean) and grow ever so slightly over the next two years to $2.4 and $2.8B.

"Quick" Model

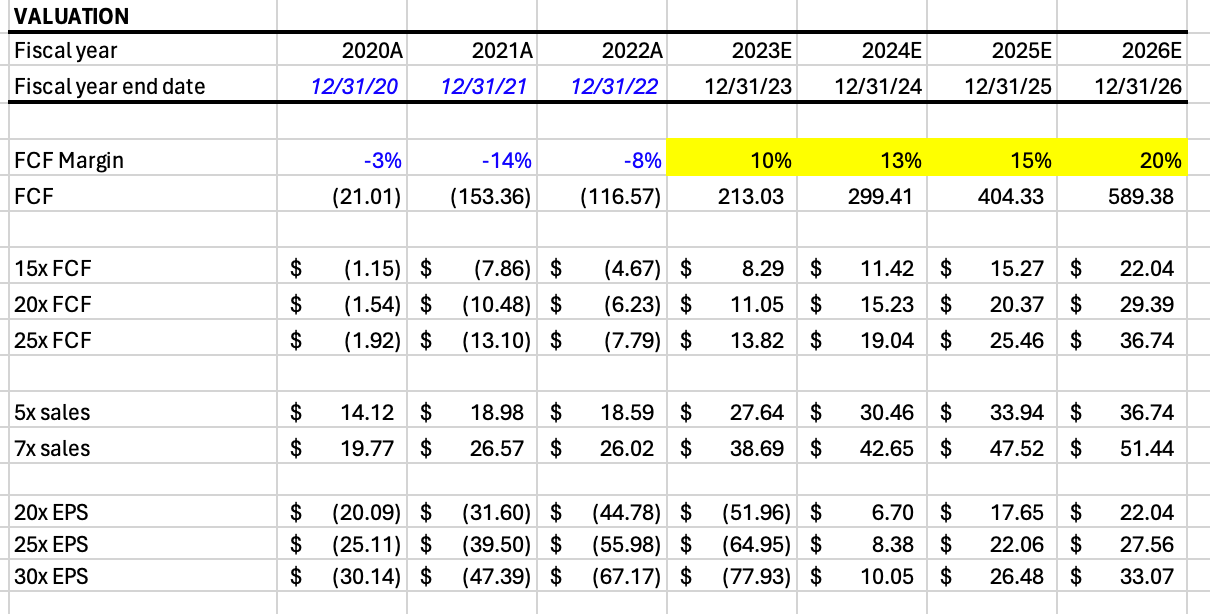

For these types of companies, where there's a large amount of assumption and great execution needed, I like to make a "quick" model.

The quick model removes a lot of the fluff (like taxes...). Now, granted, the fluff is worth a lot, but we're also likely to be really wrong in a lot of our assumptions, so things balance out in the end.

In the case of Unity, I have modeled revenue growth somewhat in line with what analysts expect. The company could grow to $1B in Create Solutions and $2B in Grow Solutions by 2026. With a 75% gross margin, this leaves us with around $2.2B in gross income.

I think we're going to see a big plunge in R&D and SG&A expenses in 2024, given the layoffs. These will slowly climb over subsequent years, but will become smaller hits percentage wise to the overall business.

Share growth will continue, albeit smaller than in the past, and we'll ultimately see around 400 million shares outstanding by the close of 2026.

Pulling all this together, and reminder you can play with this by becoming a premium member, we get the table above for valuations.

We're most interested in the numbers on the right. The expectations I've laid out leave little room for an investment growth through 2026 at today's prices.

So, if one were considering an investment in Unity, you either have to believe that costs will come down more drastically, or that revenue growth will be much more rapid than we've seen. It's likely, if at all, going to be the latter. And if I were guessing, I'd say that sharper revenue growth would come from outside of gaming.

I wouldn't want to sway the reader either way, but all things considered, it'd be risky to invest today for the long term without hearing first how Whitehurst plans on turning the company around.

Conclusion

Like all companies I cover, I'm deeply interested in how Unity performs going forward. There's a lot of risk in buying here, but there's also equal risk in shorting.

I think it's quite clear that Unity is trading at the fairest possible value for a struggling duopoly in a massively growing market. There's a chance for huge upside, but if reputational damage cannot be overcome (and gamer's don't easily forget) then there's a good chance an investor today does not get a decent return.

As mentioned in the closeout of the last section, a lot of potential growth for an investor here relies on the plans of CEO Jim Whitehurst. He'll have to put forth and execute on a plan that shows rapid revenue growth, or drastic cost cutting measures to make this name viable in the near to mid term.

My final take here in this piece is that Unity may be a valuable acquisition for a number of companies. If it were to continue trading at these levels, an $18-20B buyout might be a viable end.