Duolingo in 2023: Earnings Highlights and What's Next

On January 1, I provided a breakdown of Duolingo. Just a few months later, Duolingo has announced its Q4 2023 results and the full year numbers for 2023.

At the time of the previous writing, Duolingo was trading at $214 per share. Since then, the share price dropped to as low as $175, before rising to $236 following a positive earnings announcement. Here is what I wrote:

the current valuation of Duolingo is based on assumptions that, as an investor, I find overly optimistic. If there was a correction bringing this name towards $150-160/share, I'd be interested. If there was a deeper push to growing the advertising business, that'd also pique my curiosity a bit.

The share price approached the 'correction' territory after a volatile period, yet it never reached a point where I felt compelled to invest. In this article, we will explore the earnings release and re-assess my conclusion above.

Duolingo 2023 Highlights

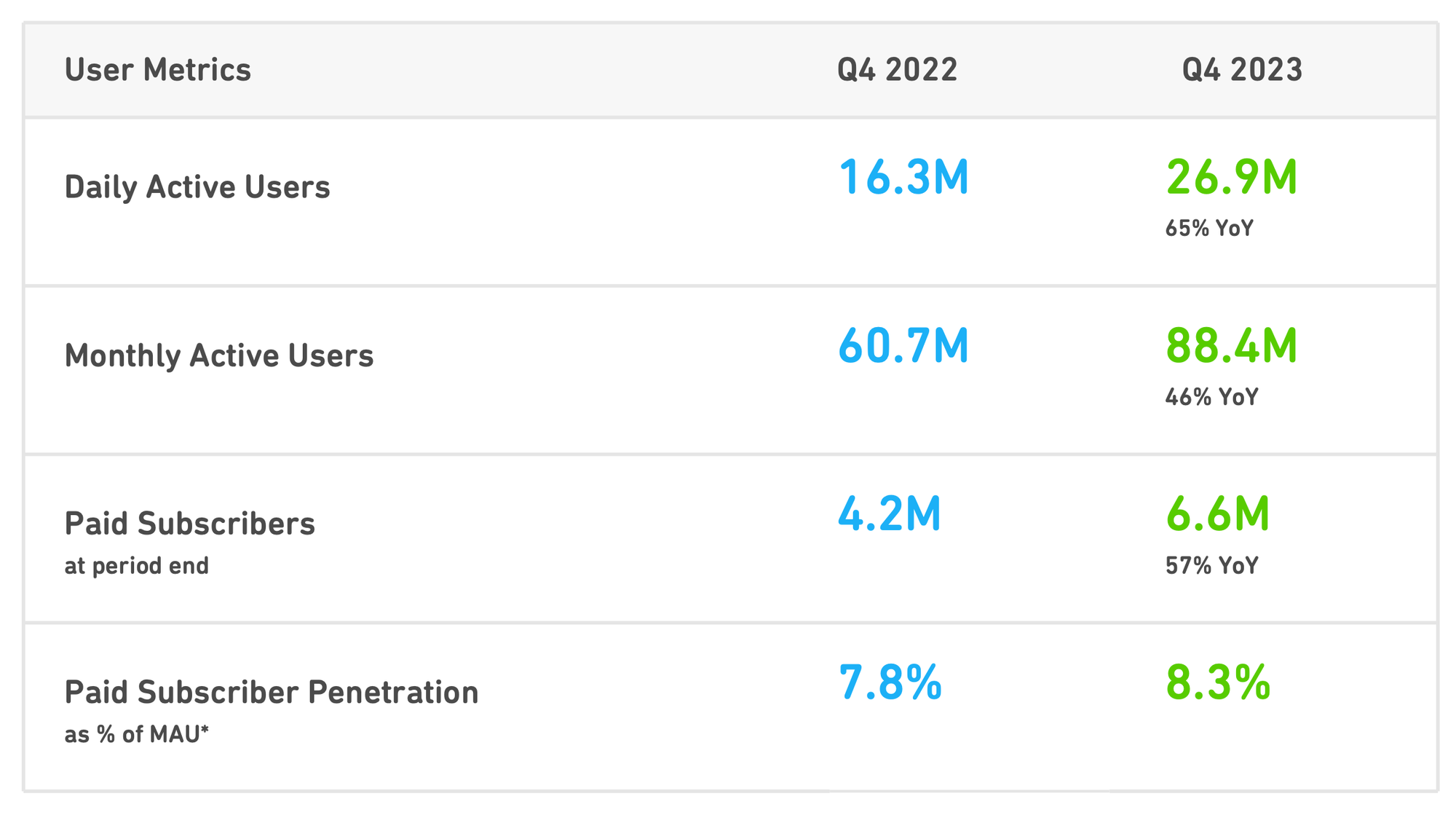

Starting with key metrics, the daily active users (DAUs) reached 26.9 million, marking a 65% increase from the same period in 2022. This was also notably higher than my model's prediction of 24.1 million.

Monthly active users (MAUs) came in slightly under what I expected. My expectation was 89.2M, but Duolingo reported a, still fantastic, 88.4M. That 88.4M represents 46% growth over 2022.

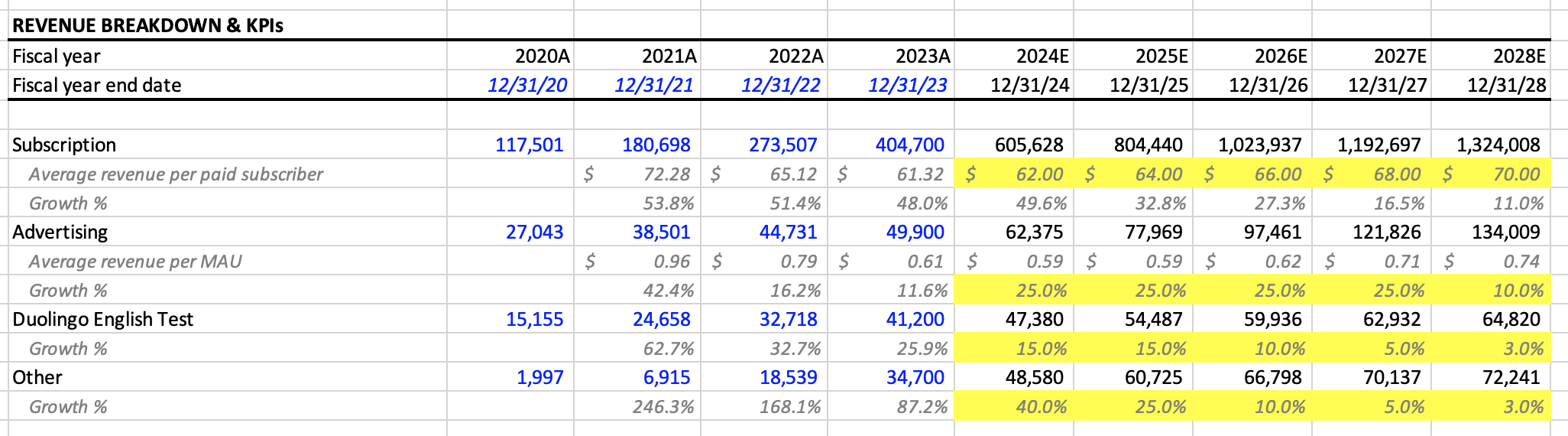

My model got a little hairy with regards to paid users and subscription revenue. I had overshot the numbers, but undershot revenue. How? With a lower assumed average revenue per paid subscriber.

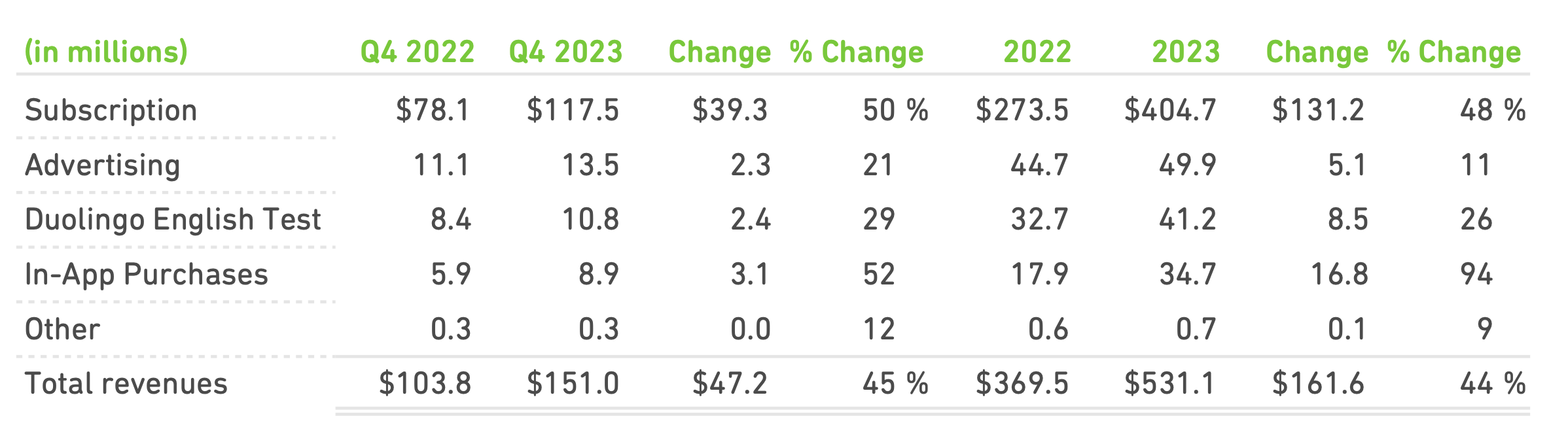

Duolingo had 6.6M paid subscribers, which represented an 8.3% conversion rate from MAUs. I had predicted 7.14 million paid subscribers with an 8% conversion rate. Revenue from subscribers worked out to $404.7M for the year, which was ever so slightly above my assumed $401.5M.

All told, most items were a few million dollars out on either side of the line. I’m happy with what was in the model, but I did have the benefit of being provided 3 quarters of information.

My Thoughts On Duolingo’s Direction

Overall, the direction Duolingo showed in its Q4 report was very much expected. The company also issued guidance for $717.5-$729.5M of revenue, which is in line with what I previously had too ($724.9M).

Upon review, my opinion on Duolingo hasn't changed significantly. I still use the application (I’m at a 284 day streak as of writing), and I’ll continue to be a customer for the foreseeable future. However, I still don’t see a clear path to market beating returns unless you happen to catch it in a trough.

Duolingo achieved profitability for the first time in 2023, influenced by interest rates—a factor that ideally shouldn't dictate profitability for an app of this nature.

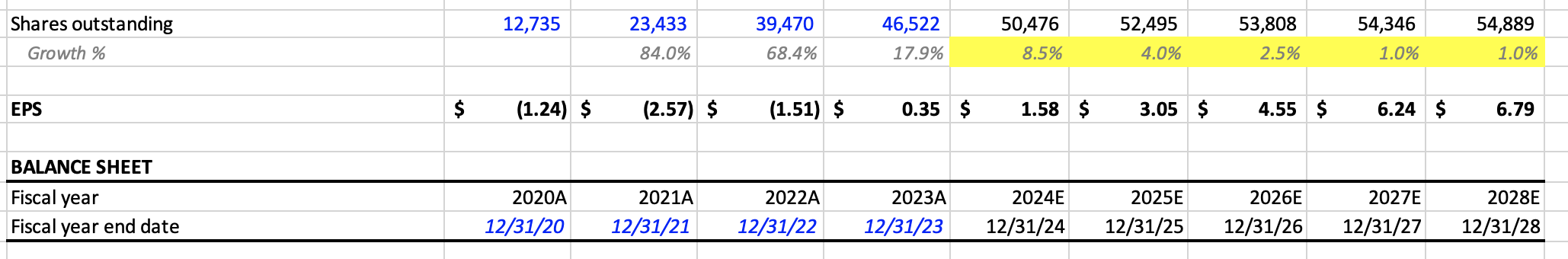

If Duolingo can keep a handle on costs this year and grow the top line to what it has projected, then we should see operating profitability, and that’d be a great sign. However, I'd appreciate a reduction in share-based compensation (given that the share count increased by 17.9% in 2023), especially if the company can maintain its profitability.

I also maintain that the company is significantly missing out on advertising revenue, which I hope will see improvement in 2024. In 2023, Duolingo had an average advertising revenue per monthly active user of just $0.61. I’m not expecting Meta like numbers, but Duolingo could quite easily double this given its reach.

Also, the rollout of Duolingo Max has been much slower than I would have hoped. I would love to upgrade to it, but it’s still not an option shown in my app. Getting those additional features out there will help give a boost to subscription ARPU, and Duolingo is going to need to see 40% growth there to hit its lofty 2024 targets.

Re-adjusting the model

The updated Duolingo model is available on the models page. It doesn’t really contain all that many updates as I am quite happy with how things look.

The most significant update involved the shares outstanding. Previously I had 2024 share growth at 6%, but have bumped that up to 8.5% to account for the SBC we’re still seeing. In 2025, I bumped from 3% to 4% also. The following 2.5% and 1% have been left in place.

The new, final year of the model has a 1% growth rate too. If anything, I do think this might be me assuming the best, and there’s a very good chance I am still underselling the total amount of shares that will be outstanding.

Another notable update was to the average revenue per paid subscriber. In the previous model I did have this at $56.25 for 2023, but Duolingo managed to hit $61.32. I have high hopes for Duolingo Max driving this higher and have changed the averages with 2024 being $62 rather than the $58 in the previous model iteration.

There were a number of other minor changes to the “as a % values” in the cash flow statement, trying to be more reflective of how the business is performing, and how things are trending.

All told, Duolingo’s performance along with the positive changes made in the model do indicate that the company has a fair value around $210 per share. Thus, the company is pretty fairly valued today at a 10% discount rate.

It goes without saying that I am doing this for enjoyment. A little tweak here, or a little tweak there could give you a valuation of $50, or $300. As a quick example, changing the WACC from 10.2% to 7% makes my model say DUOL is worth $370 per share, and you’d be silly not to buy with that margin of safety. So, do your own due diligence and let me know where you think I could be wrong on this name.

Member discussion