Duolingo Uncovered: A Deep Dive into Its Learning Impact, Business Model, and Future Potential

As a dedicated user, I’m deeply familiar with Duolingo, a popular language-learning app. Take a look at this screenshot:

Displayed is my current streak on the app. For the last 226 days, I’ve consistently opened Duolingo to complete a lesson.

Primarily known for its language courses, Duolingo has recently expanded to include math and music, diversifying its educational offerings. However, most learners, including myself, flock to the app for its extensive language options. From widely spoken languages like Spanish and English to unique choices like Welsh and even fictional languages like Klingon, Duolingo caters to a diverse range of linguistic interests.

The teaching approach is what sets Duolingo apart. It's not about formal lessons or memorizing rules; the app employs an intuitive, discovery-based method that lets learners naturally grasp the language.

After maintaining a 226 day streak, I feel somewhat equipped to share my insights on Duolingo's teaching effectiveness. This breakdown isn’t just a review of the app’s educational aspect; we'll also delve into its business model. So, let's dive in.

What is Duolingo?

Duolingo, available primarily on iOS and Android, is an app widely used for its quick and accessible approach to language learning. With millions of daily users, it helps people develop and maintain proficiency in various secondary languages.

My personal journey with Duolingo began with choosing to learn Spanish. After 226 days, I can't claim fluency, but I've grasped the basics well enough to understand simple conversations. I don’t believe you could gain fluency using Duolingo alone, but I do think it can help you develop a great base.

One area where I find Duolingo falls short is in developing advanced speaking and listening skills. The app's format of short, structured lessons doesn't fully mimic the complexities of real-life conversations. To achieve true fluency, combining Duolingo’s lessons with watching TV shows in the target language and engaging in conversations could be highly effective.

Alongside language learning, Duolingo also has a childhood learning application “Duolingo ABC.” Duolingo ABC helps teach children about letters, sounds, and early words.

Additionally, Duolingo has branched out with "Duolingo ABC," a learning tool for children, focusing on letters, sounds, and early words. More recently, the app has introduced math and music courses. While these new additions don't cater specifically to me, they indicate Duolingo's ambition to expand beyond language education. The CEO, Luis von Ahn, has stated that for now, their focus is on integrating these new subjects effectively.

Yeah. I mean, you're not going to see us expand in every single subject at least not for the time being. I mean, in fact, you're not going to see us be adding more subjects other than math and music. Maybe we'll add a few other languages, yes, like foreign languages, but you're not going to see us add other subjects in the short to medium term.

We're very committed to making math and music succeed. I mean we haven't even launched them. So, you cannot possibly say they are successful yet in the main app because we haven't even launched them. So, we're very committed to making them succeed.

Quote from Q3 earnings transcript

Duolingo also offers an English language proficiency test which contributes nearly 10% of the company's revenue. This segment, however, is the slowest growing part of Duolingo's business.

In summary, Duolingo is primarily a language learning application. Yet, as it ventures into new educational areas, its role in the world of online education might evolve significantly.

Our mission is to develop the best education in the world and make it universally available.

- Duolingo's Mission

Who uses it? What’s Duolingo’s target audience?

Duolingo's target audience spans a wide range, from young learners to adults seeking language proficiency for various purposes. It’s me, it’s you, it’s the three-year-old who can’t read yet, and it’s the English as a second language student looking to validate their skills.

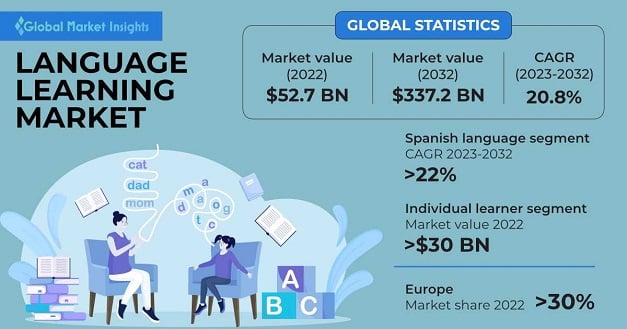

The language learning market is estimated to be worth around $60B today and growing at a 20% compounded annual growth rate (CAGR) through the next decade.

Growth drivers include globalization which is resulting in an increasing demand for multilingualism. Combine this with the rising trend of e-learning, and you have a recipe for success for applications like Duolingo.

It is worth noting that the figure above comes from all markets. This figure encompasses a diverse range of language learning methods, from digital apps like Duolingo to traditional classroom teaching, one-on-one coaching, and group learning sessions.

Still, Duolingo happens to have a large number of users, despite the potential for competition and variety of offerings.

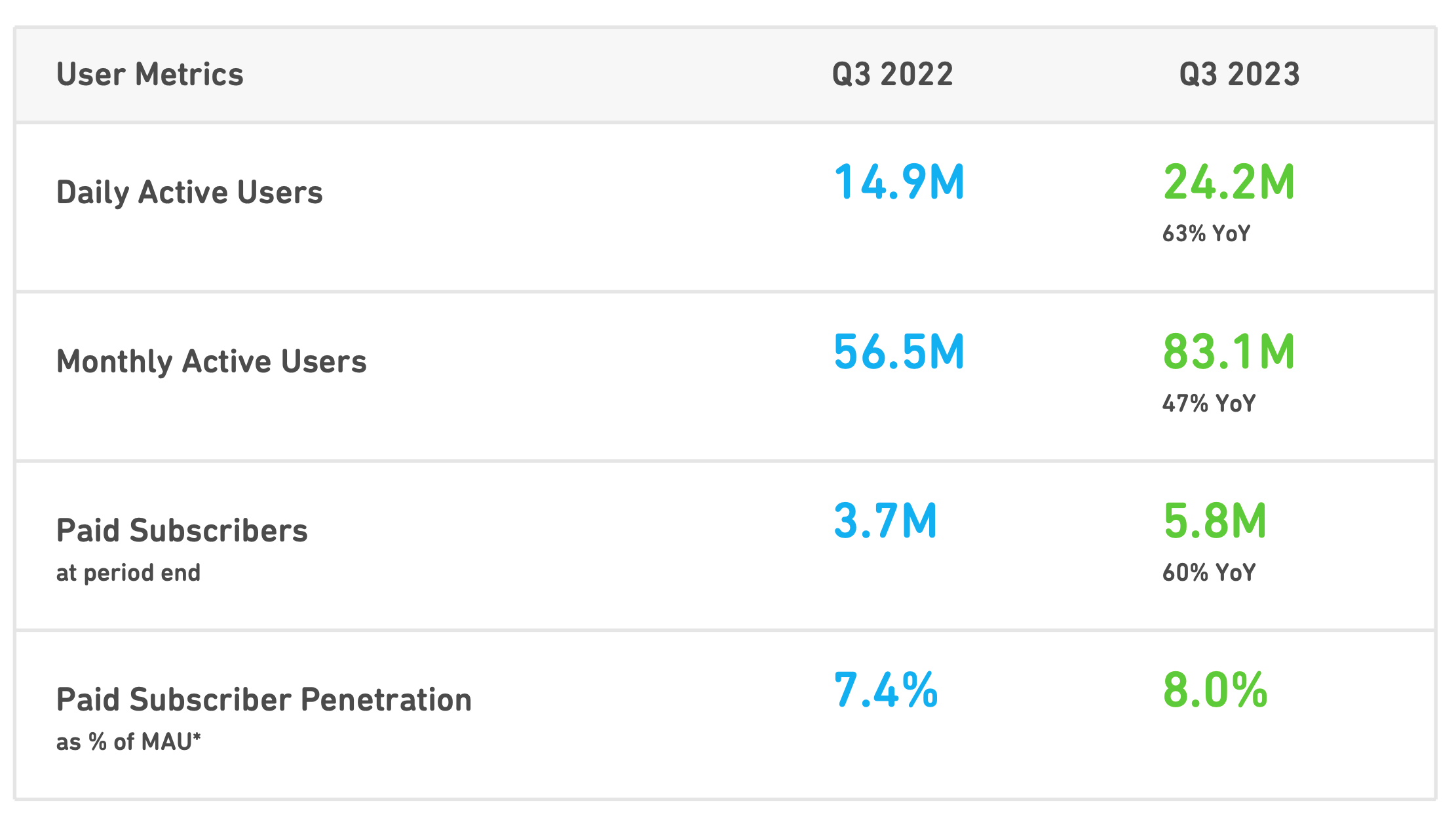

Per the company's most recent Q3 filings, there are 83.1 million monthly active users on Duolingo. With just north of 8 billion people in the world that means that 1% of the world's population is using Duolingo monthly.

Having 1% of the world's population under your wing (pun absolutely intended) is incredible. However, this level of market penetration poses challenges for future user base growth.

In a blog post closing out 2022, Duolingo pointed to an increase in travel as a way to get users on the app, and that worked out quite well (the 83.1M could be compared to 56.5M the year prior).

The resurgence of travel in 2023, as indicated by record TSA numbers, has likely contributed to Duolingo's increased user base, as more people seek language skills for travel. The TSA is constantly reporting a record number of travelers, and people are looking to "get out more" after those COVID years. Can this continue? I don't hold a crystal ball so I couldn't tell you. Without a continuation though, Duolingo may find user counts stalling in the coming years.

How does Duolingo Make Money?

Duolingo makes money in one of four ways:

- Paid subscriptions

- Advertising

- Duolingo English Test

- In-App Purchases

The list is ordered by their current revenue contribution, with a speculative view on their potential future significance. Let's discuss each.

Paid Subscriptions

Paid subscriptions allow users of Duolingo to avoid advertisements, and use unlimited lives. Non-subscribers encounter ads after each lesson and face a limit of five mistakes, after which the app becomes inaccessible for a few hours.

Subscribers can choose from a number of plans, but the primary one is Super Duolingo, which is billed at (in the United States) $12.99 per month when paid monthly, $6.99 a month when paid annually, or $9.99 a month for a 2-6 person "Family Plan" when paid annually.

Duolingo is also working on bringing a new subscription to the market, Duolingo Max. Max includes the same features as Super Duolingo, but brings a couple of AI features to users called "Explain My Answer" and "Roleplay."

Both of these features are powered by OpenAI’s APIs, the same ones that power GPT-4.

Explain My Answer helps learners by explaining why they were correct or incorrect in a lesson. Clicking a button after completing an exercise pops the user into a chat like experience which provides the user with examples and allowing them to ask further clarifying questions.

“Roleplay” is the real killer feature here in that it allows users to practice real world conversations. Things like discussing vacation plans, or ordering coffee in a shop.

While I’ve not had a chance to try Duolingo Max yet (it’s not an option for me in app), I do believe these types of features will go a long way to enabling users to learn languages more efficiently. A longtime complaint of mine about my Duolingo adventure is the feeling that I’m not getting a chance to try out conversational Spanish, Roleplay could change that.

Duolingo Max is a pricey add-on at a monthly cost of $30 in the U.S. or $200/year on the family plan.

Advertising

As mentioned above, if you don’t pay for Duolingo, you will see an ad after every lesson.

With 24.2M daily active users, and close to 7M of them paying (8% of MAUs are paid subscribers), we can assume that 17.5M daily active users see an advertisement when using Duolingo.

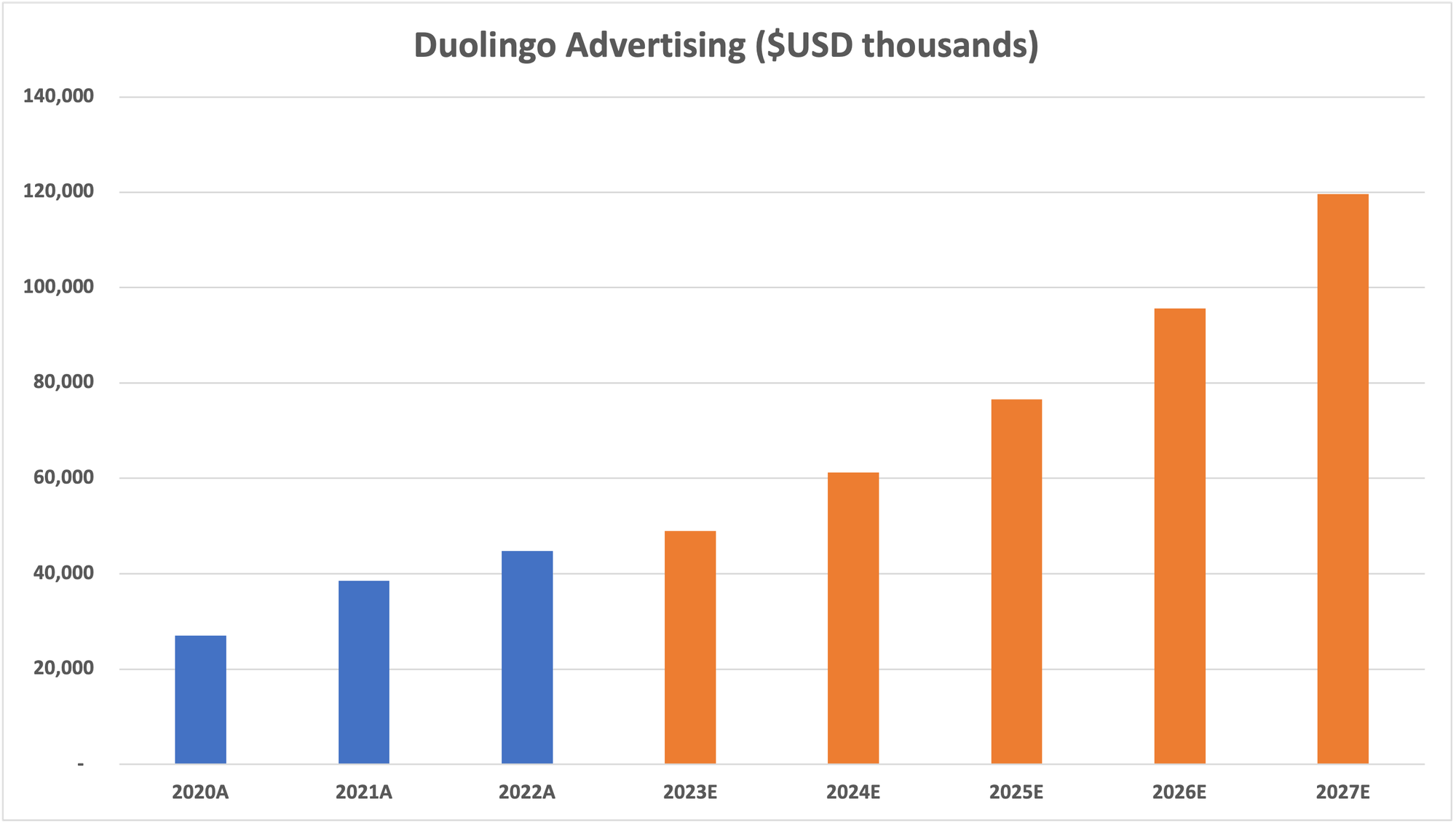

As subscribers, DAUs, and MAUs can change and grow over time, let’s keep the math simple. In 2022, Duolingo's advertising revenue averaged about 74 cents annually per monthly active user. That seems... really low. So low that I had to check my math a number of times.

Here’s the math: Duolingo made $44.7M in advertising revenue in 2022. The company had 60.7M monthly active users. Barring a massive shift in Q4 of 2023, things won’t look much better either.

My projection estimates a 9.5% increase in Duolingo's ad revenue for 2023. Should it grow at that rate, while growing monthly active users at 47% to 89.2M (again, in-line), then we’re looking at 55-cents in ad revenue per MAU.

For those that have used Duolingo’s ad-supported product, this might not come as much of a surprise. The company tends to use that ad space to push signing up for Super Duolingo.

So, then, the good news is that Duolingo could massively increase advertising income. For context, Meta, although operating under a vastly different model, generates an average of $11 per user worldwide. Duolingo has a worldwide base.

Some quick envelope math here says that if Duolingo can get to 100M monthly active users (my model has them there in 2024) with 8% of those premium, that’d leave us with 92M MAUs looking at ads. 92M MAUs, even at a quarter of Meta’s average revenue per user would generate $250M.

For a business I have generating $658M in revenue in 2023, $250M is quite a nice chunk of change. However, Duolingo has not shown significant interest in expanding its advertising strategies. I feel that may change in the future if user growth does slow down.

English Language Exam & Other

I’ll combine these two. They are great little businesses for sure, but they don’t move the needle for a company that’s currently trading with a $10B valuation.

The Duolingo English Test brought in $32M in 2022 and will close out 2023 at about $42M. There will be future growth here, but it will continue to be a small part of Duolingo’s business.

“Other” is primarily made up of in-app purchases of things like gems and lives. They make a decent amount of money today, closing in on $35M this year, but it’s unlikely to be a large part of the business going forward.

The Future of Duolingo

This section is particularly exciting as it allows me to adopt a 'Product Manager's' perspective, exploring how Duolingo could evolve and adapt in the future. We’ll combine my opinion with some of Duolingo’s disclosed paths too.

Enhancements to Gamification

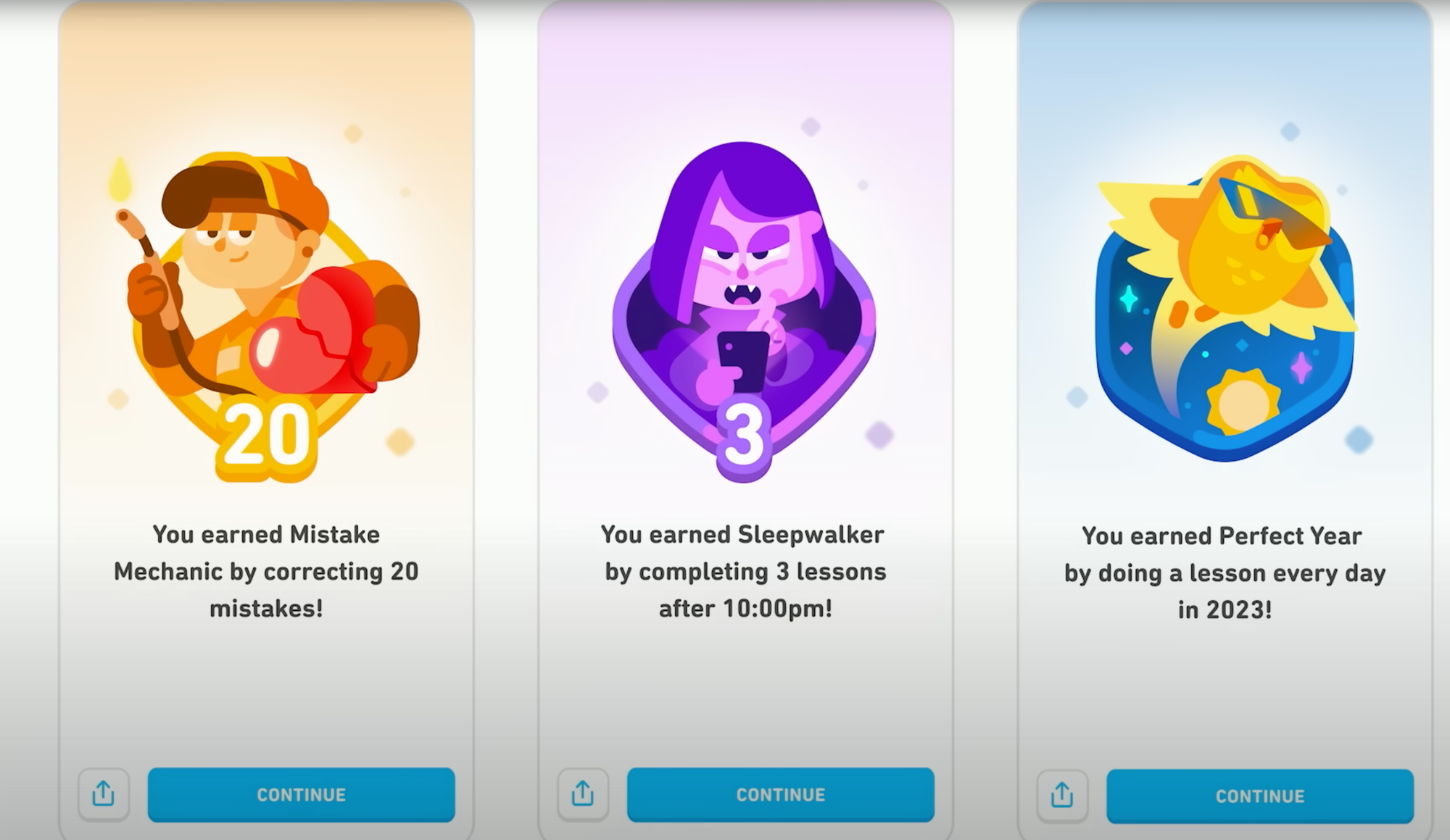

Gamification keeps users coming back. Achievements, challenges, trophies and rewards help turn monthly active users into daily active users, and daily active users are more likely to spend money.

At DuoCon, Duolingo announced plans to enhance gamification by making achievements more appealing and rewarding. These are now live on Android.

I am a big believer in gamification, and I think that Duolingo can go much further than they do today to get people coming back to the app.

An innovative approach could be incorporating real-world tie-ins into the lessons. I’m writing this just after Christmas. It would have been great to have a couple of “bonus” lessons with Christmas terminology. “Merry Christmas,” “Happy Holiday’s,” “thank you for this gift.” You get the idea.

Completing Christmas, or New Year’s, or Valentine’s Day, or even President’s Day special lessons could earn awards and achievements in the app. Notifications about these special lessons would get intrigued users, already experiencing these events in the real-world to want to check in and try things out.

Why stop at holiday’s too? The Super Bowl? Oscars? World Cup? Olympics? All of these events could have their own little lessons.

Duo, the owl, was also in the Barbie movie in 2023. The company should have made a Barbie special lesson around that time to tie these things together.

AI

AI will undoubtably play a role in the future of this company. Today, Duolingo is heavily invested in AI research, and the company has access to a treasure trove of language learning data. In the future, this data could be leveraged to accelerate and simplify the language learning process.

The future of AI and Duolingo would be plenty of new features that enable language learning. If I Google “what’s the best way to learn a new language” much of the discussion leads towards immersion. That’s all fun and good if you can afford to travel for extended periods, but many cannot.

Envision a version of Duolingo that guides users through immersive, conversation-based learning, even correcting pronunciation in real time. This kind of functionality is coming, it’s just a question of if Duolingo gets there first and builds an effective version of it for a good price.

Additional Education

While Duolingo CEO Luis von Ahn has stated that the company currently has no plans to expand beyond Math and Music courses, the potential for branching into areas like science and complex games seems both feasible and beneficial.

There’s a lot of potential for science lessons and teaching more complex games like chess through Duolingo. Their platform would support these lessons, it’s not a question of complexity, it’s more just a question of finding the right educators, and finding the best ways to promote this type of content.

Sure, I get the need for focus, but also believe that more options on an application like Duolingo lead to better outcomes and more interest over the longer term. If the Duolingo team didn’t also believe that, they probably wouldn’t have added languages like Klingon as options.

Pros & Cons to Investing in Duolingo

I like to bring together all the pros & cons into one section. Not surprisingly, Duolingo’s major pros and cons, for me, touch upon AI, but there are other’s to discuss too.

Con: Easy to enter market, and many participants

When we spoke about market size and total addressable market earlier in this breakdown, we touched on the ease of entry. Teaching a language can be done by anyone with knowledge of two languages. When it comes to learning a language, you could even choose to learn it without any sort of instruction at all.

Creating a language learning app and developing a curriculum, for instance, Spanish for English speakers, is relatively straightforward. This is a “con” to investing in Duolingo. The company has little technical moat (we can debate data momentarily), but it does have incredible brand recognition.

... but turning that con into a pro...

Brand recognition, and being known for a high-quality experience are how Duolingo will overcome the ease of entering the market. Prior to my 200+ day streak, I knew of Duolingo as a place to learn languages, and I’m sure that many others who have never even tried the app know of it too. Duolingo's synonymous association with language learning gives it a significant edge in a competitive market.

Con: Stock-based compensation is high

I have to throw this in here. It's a given for many smaller, high-growth tech companies that stock-based compensation is used in abundance, and Duolingo is no different in this regard.

The company, in 2022, had revenues of $369M with stock-based compensation of $73.8M or 20%. This is high, not as high as some, but you don't want to find your investment on the wrong side of this dilution.

For this year, Duolingo's projected stock-based compensation is about $100M, constituting approximately 19% of its significantly increased revenues.

The plan Duolingo have in place for stock issuance can get rather complex - here's the short end of it. In 2021, 9 million shares were authorized for award plans and employee stock purchase plans (today there are ~42 million shares outstanding). Every January, the board can increase this amount and did so by 2.3 million in 2023.

In the model we're about to discuss, I assume that there will be 49 million shares outstanding in 2027. This could, given the current trajectory be quite "off" and we might see closer to 60 million.

At the time of writing, barring any further increase, there are 3 million options exercisable and 2.2 million restricted stock units outstanding.

Further, the founders are eligible for 1.8 million performance-based RSUs. The hurdles here are considerable though, so this is kind of a moot point. Should the company's stock price hit $816 per share all 1.8 million shares would have been distributed - I'm sure many long-term holders would be too happy with the share price to notice the dilution.

Pro: The Advertising Lever

We spoke about this earlier, but I believe it to be one of the best levers available to Duolingo right now.

The company has an audience nearing 100 million people around the globe and isn't doing nearly enough to monetize all those utilizing the free plan.

With an audience of this size, Duolingo need not utilize the "spammy" ads we tend to see on free-to-play mobile games, but could instead partner with larger global brands.

Will this be difficult? Absolutely. As mentioned earlier though, Meta is able to get $11 ARPU around the globe. If Duolingo strived to hit half of that number then the company would double its revenue today.

Pro & Con: Artificial Intelligence

Duolingo's treasure trove of data is a significant moat. The company collects the results of billions of language learning events per day which is unmatched in the learning world.

This data is built into Duolingo's application "BirdBrain" which can then shape a user's learning experience to be better for them. Better for them keeps them coming back!

By adopting OpenAI's technology to enhance and add features to the application, Duolingo can become an even better place for learning over the longer-term. Soon, you won't need immersion, you'll be able to open up Duolingo and immerse yourself there. Quick back-and-forth dialog that's catering to your current level offering advice along the way.

This type of application will come, and it's very likely that Duolingo will be among the first to market, undoubtedly with the best product. Why? Because of that dataset. Data is going to be the moat going forward, and Duolingo has it.

So, then why did I list this as a con?

Well, language isn't "new." Despite Duolingo's extensive data, it's not proprietary; theoretically, anyone could use available datasets to create a similar conversational language learning tool.

Even if a competitor didn't come along to help you learn languages, there's another AI risk: the lack of desire to learn a new language.

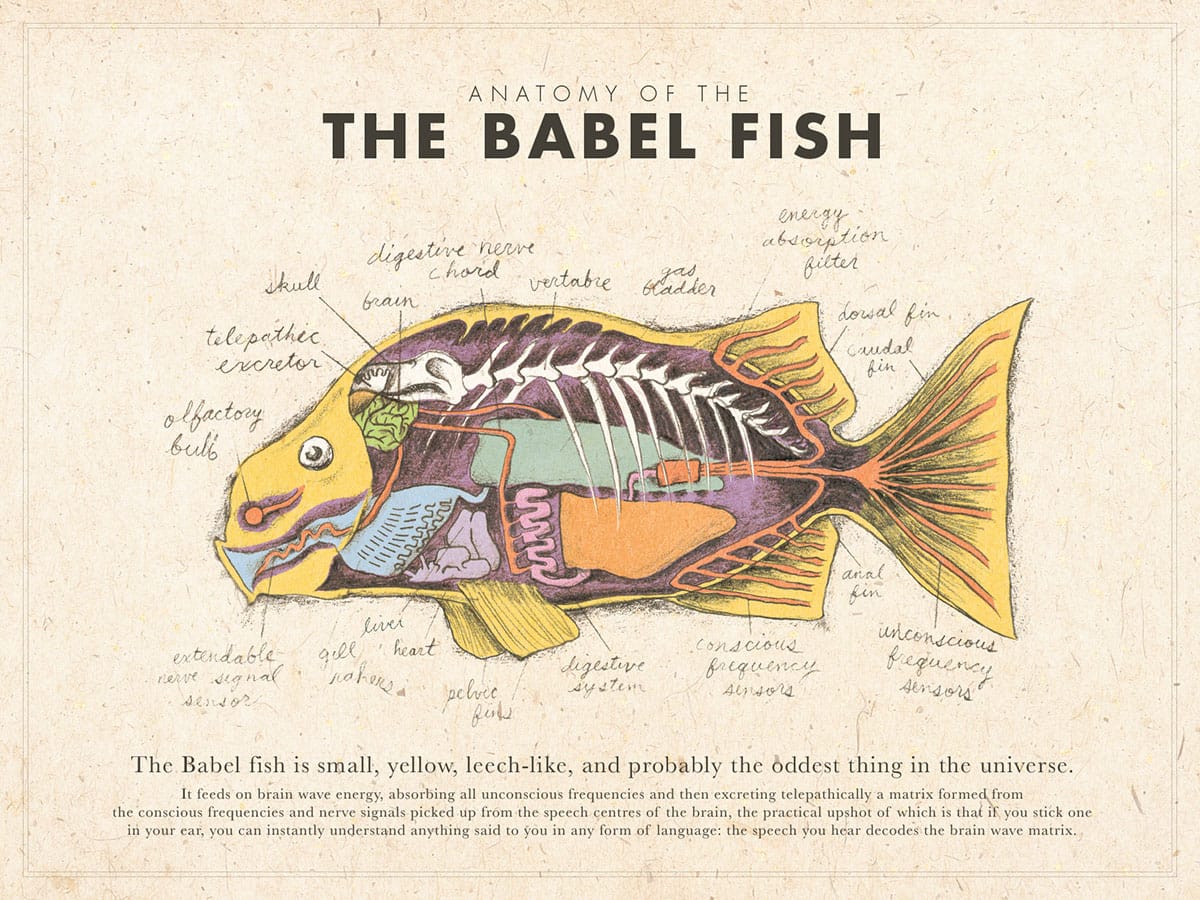

While we won't have a biological Babel fish that was envisioned by Hitchhiker's Guide to the Galaxy author Douglas Adams, we will almost certainly get a tech-based one in the coming 3-5 years.

The practical upshot of all this is that if you stick a Babel fish in your ear you can instantly understand anything said to you in any form of language. The speech patterns you actually hear decode the brainwave matrix which has been fed into your mind by your Babel fish.

- Douglas Adams

OpenAI already offers transcription and translation with its Whisper product.

Whisper, while not "instant" today, could conceivably become near-instant as the technology develops.

I realize that this is a hypothetical "sci-fi" type scenario, but I do not believe it is far-fetched. While translation and speech-to-text are largely solved challenges, combining them for near-instantaneous processing is complex but achievable in the future.

The question is, when it does happen, what does it do to the human desire to learn new languages? That is something I am not qualified to answer in the slightest.

Duolingo Financial Model

If you're a subscriber to Tech Breakdowns, the model is available for download on the Models page. The model allows you to adjust key variables to align with your projections and determine a fair share value based on your analysis.

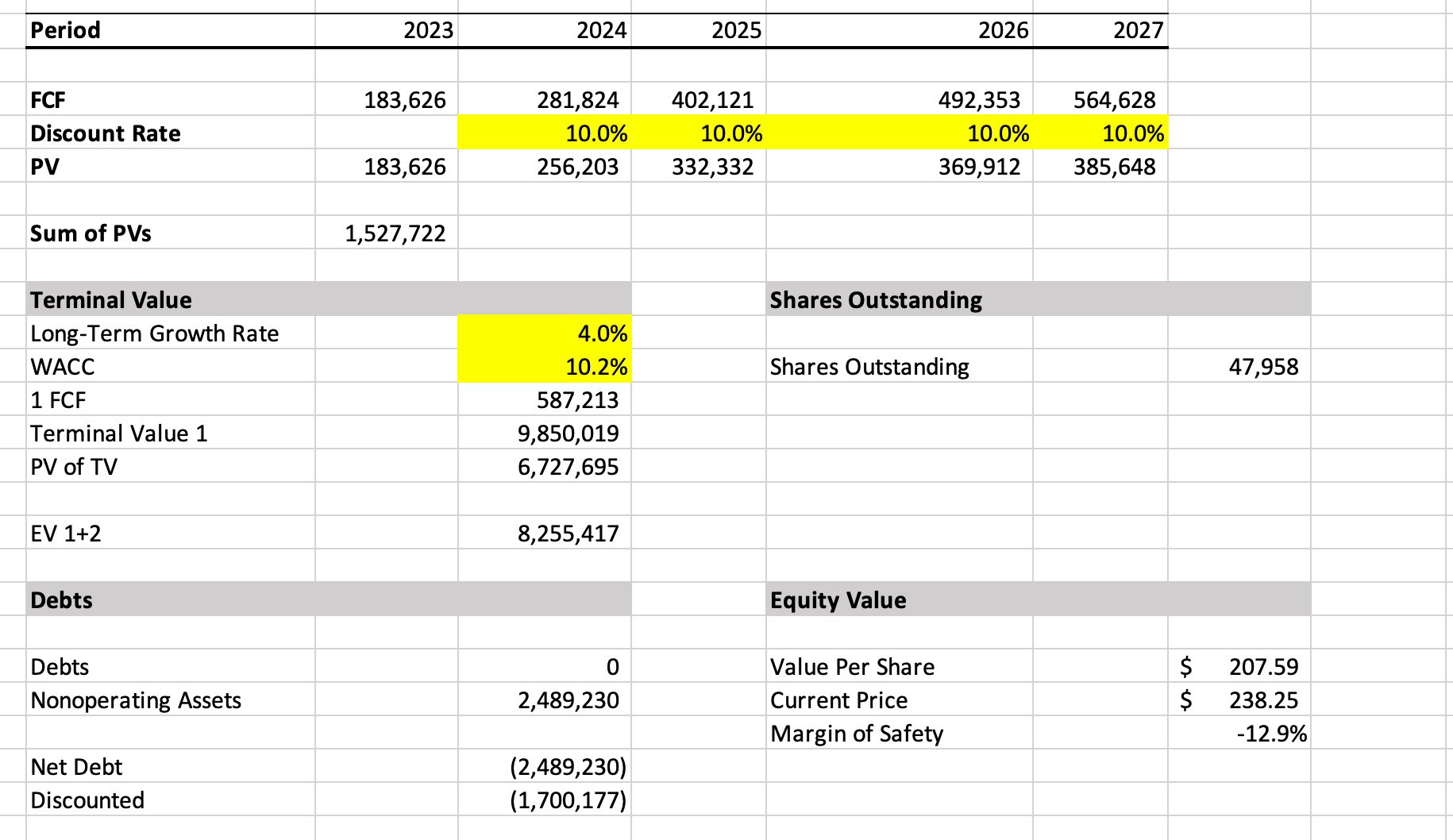

For me, the story I came up with reaches a fair value of $207 per share. This assumes a 4% long-term growth rate and was calculated at a 10% discount rate (I really think something like this should probably be a 12% discount though).

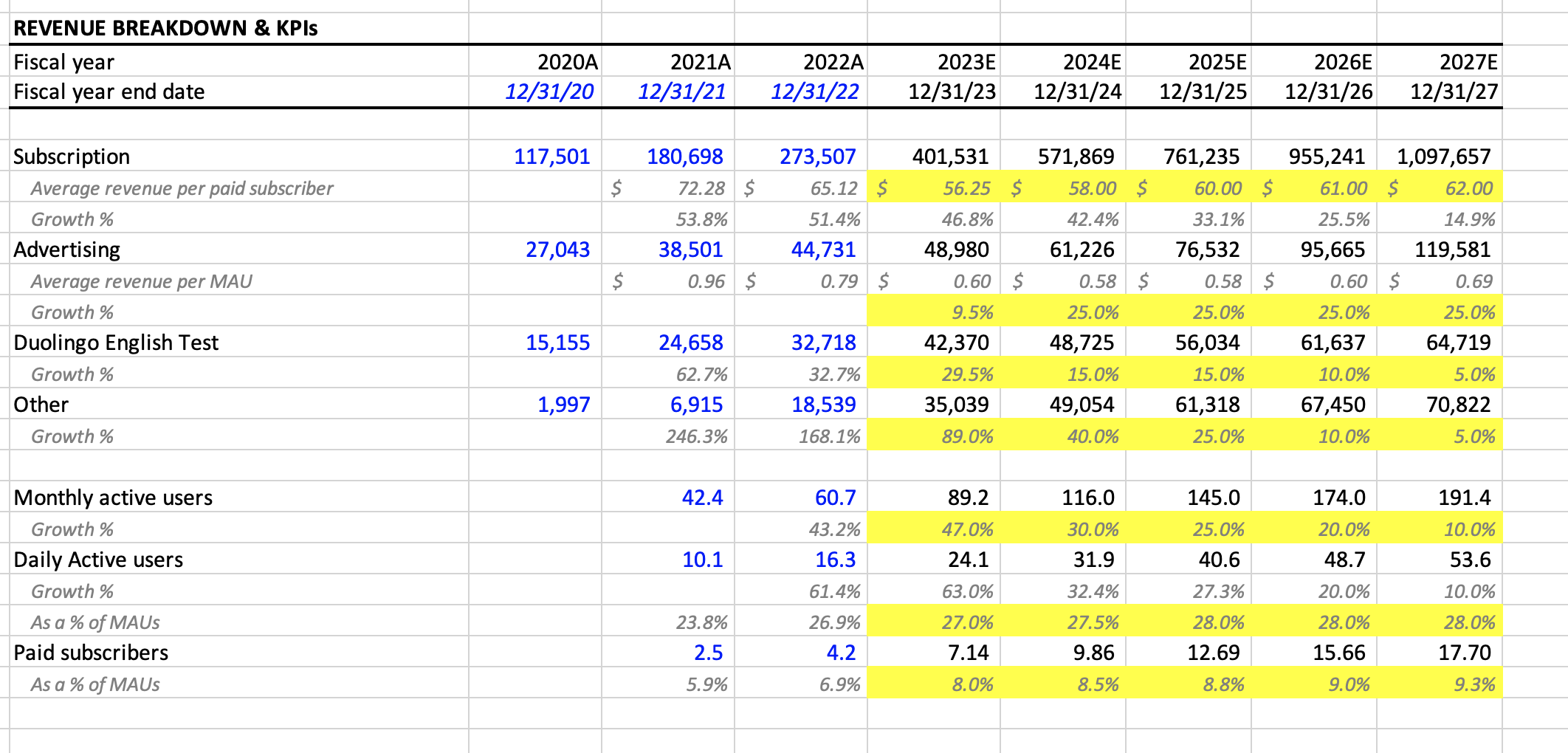

What assumptions get us to this value? Well, let's start with users. My model assumes a steady increase in Duolingo's monthly active users through 2027. By the close of 2027, Duolingo would have more than doubled its monthly user count to 191.4M, over 2% of the world's population.

The model projects an increase in the subscriber conversion rate to 9.3% by 2027, up from 8% currently. These users today earn Duolingo an average of $56.25 per year. I have this value going back up thanks to tools like Max to an average of $62 per year in 2027.

These numbers represent 47%, 42%, 33%, 25%, and 15% growth in Duolingo's subscription revenue over the next five fiscal years - that'd be an incredible feat.

Advertising that we spoke about earlier in depth will only grow by 9.5-10% this fiscal year, but I truly believe we'll see Duolingo pull that lever in the future. To maintain a conservative outlook, I've projected a 25% annual increase in advertising revenue through 2027.

Even with that high-rate of growth, Duolingo would still be making ~$0.70 per MAU annually. There's plenty of room there for people who believe the advertising lever is one that will be pulled.

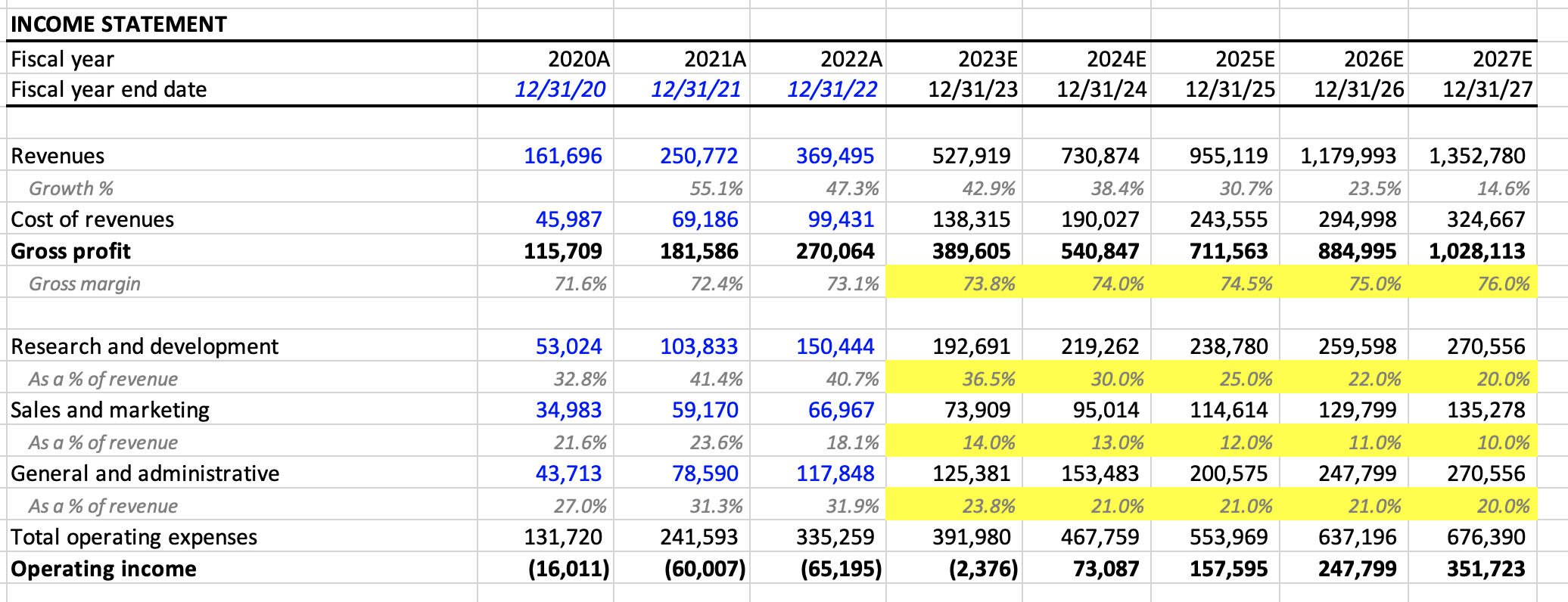

Here's how it looks:

On to the income statement then - The model forecasts gross margins reaching 76%, which I consider the potential peak for Duolingo.

R&D costs will grow, but should become a much smaller part of revenue over time. In 2022 they were 40.7%, 2023 should close at 36.5%. I have them falling to 20% by 2027.

A similar story here for Sales & Marketing and General & Administrative. Both will fall in terms of percent of revenue over time. Should the company be able to cut or maintain costs in these categories a lot better then my $207 per share could be "way off."

Here's a look at those costs:

Closing Thoughts

I love Duolingo! It's a fantastic application and it's helping me learn Spanish. I know that I'll need more than Duolingo to become "fluent," but for now the application is allowing me to build a great base.

From a company standpoint, Duolingo is a very well run business that will be profitable this fiscal year for the first time.

However, the current valuation of Duolingo is based on assumptions that, as an investor, I find overly optimistic. If there was a correction bringing this name towards $150-160/share, I'd be interested. If there was a deeper push to growing the advertising business, that'd also pique my curiosity a bit.

For now, I'll be following along with the company's story to see how it all plays out.

Member discussion